- Moving the market

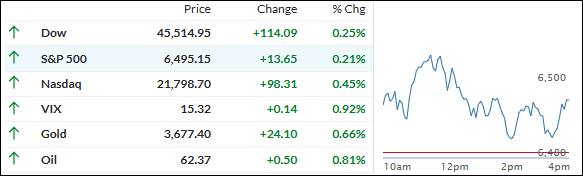

The Nasdaq popped to a new record this morning, while the S&P 500 held mostly flat as Wall Street geared up for a week packed with crucial inflation numbers.

Nvidia bounced nearly 2% and Meta added over 1%, joining gains from other big tech names like Amazon and Microsoft, which helped the “Magnificent Seven” keep some heat under the market.

Traders are fixated on the upcoming Producer Price Index on Wednesday and Consumer Price Index on Thursday—two reports that could set the tone for what’s next with the Fed.

The weak jobs print from Friday has traders betting the Fed will finally go ahead with a rate cut at its September meeting, with chatter about the chance for a half-point move growing a bit louder.

Gold’s bull run hasn’t missed a beat, conquering $3,600 for a fresh record, while the dollar softened, and bitcoin raced back up toward Friday’s highs as bond yields drifted lower.

The way I see it, this “bad news is good news” vibe has powered rate cut hopes, but it all hinges on how these inflation reads come in.

Odds are now around 15% that we get a 0.5% cut from the Fed. But the question on my mind is: If the Fed finally delivers that cut, will equities rally—or will we get another bout of “buy the rumor, sell the fact”?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Despite kicking things off on a positive note, the major indexes just drifted sideways for most of the day, but still managed to finish modestly in the green.

The way I see it, traders didn’t have much conviction either way—which made for a pretty uneventful session.

Our TTIs told a mixed story: the international TTI actually showed some real strength and pushed higher, while the domestic one basically treaded water all session.

This is how we closed 09/08/2025:

Domestic TTI: +6.29% above its M/A (prior close +6.38%)—Buy signal effective 5/20/25.

International TTI: +9.96% above its M/A (prior close +9.52%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli