- Moving the market

The S&P 500 started strong, hitting a new intraday high early in the session—its fourth straight record, but the Dow was leading the charge thanks to Boeing’s boost.

Boeing rallied after President Trump celebrated Uzbekistan’s $8 billion deal, and chatter about a major U.S.–China Boeing agreement kept buyers interested.

Yesterday’s breakout accelerated late as Nvidia popped almost 4% on fresh news of a $100 billion OpenAI data center partnership.

Still, with record highs coming fast, investors are keeping an eye on downside risks—like the threat of a government shutdown, given Congress’s funding gridlock and a looming September 30 deadline.

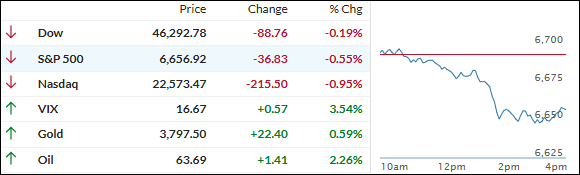

Momentum ran out after Powell’s comments on labor market weakness and uncertainty about the next rate cut. Bears seized the opportunity, major indexes turned red, and the short squeeze fizzled for the day.

Mega-cap tech suffered its worst drop since early August even as bond yields slipped. The dollar flattened out, gold set another overnight high, and bitcoin kept moving around its recent lows.

Now, traders are watching for Friday’s personal consumption expenditures price index—the Fed’s favorite inflation measure.

Will this print be the deciding factor for the next move in equities?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Today’s early strength didn’t stick around long for the bulls. As the session wore on, the AI sector hit a rough patch and Powell’s latest remarks did little to clear things up, leaving traders guessing.

By the close, major indexes were in the red, mostly thanks to tech’s slide.

Interestingly, our TTIs didn’t follow the crowd—they eked out a gain even as most stocks sold off, which makes it clear that today’s selling was all about tech and AI, with other areas holding up fine.

This is how we closed 09/23/2025:

Domestic TTI: +6.17% above its M/A (prior close +6.04%)—Buy signal effective 5/20/25.

International TTI: +11.63% above its M/A (prior close +11.37%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED? Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli