- Moving the market

The S&P 500 jumped to another record this morning after wholesale inflation surprised traders by falling—a welcome sign for anyone hoping the Fed will finally pull the trigger on a rate cut next week.

Oracle stole the show, with its shares rocketing more than 40% after a blockbuster AI-fueled forecast that rippled out across the tech sector.

The latest Producer Price Index (PPI) showed wholesale prices dipping 0.1% in August instead of rising, and even core PPI dropped when economists had expected an increase.

That was music to Wall Street’s ears, especially with tomorrow’s Consumer Price Index (CPI)report on deck, and the mood was optimistic that inflation might be cooling at just the right time for the Fed to act.

By the close, though, early gains fizzled, and the indexes slipped back toward the flatline—so not much changed in the end.

The Mag 7 group lagged, but Goldman’s AI Leaders basket surged as investors piled into the hottest tech names.

Bond yields and the dollar both dipped, gold closed at a fresh high (even if it couldn’t hold its best levels), and bitcoin pushed above $114k for the first time in weeks.

The way I see it, the market is hanging on every inflation headline now. The real question: Will tomorrow’s CPI print keep the Fed on track for a cut—or throw a wrench in the rally?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

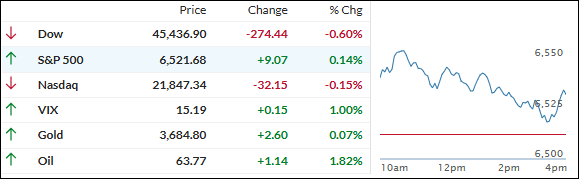

The S&P 500 and Nasdaq looked upbeat when the bell rang, but that strength didn’t last—both indexes faded as the session wore on.

In the end, only the S&P managed to cling to the green, and even that was by the narrowest of margins.

Our TTIs followed a similar pattern as yesterday: the domestic TTI dipped a little, while the international TTI posted a solid gain. It looks to me, global markets are showing a bit more momentum just as the U.S. rally takes a breather.

This is how we closed 09/10/2025:

Domestic TTI: +5.86% above its M/A (prior close +5.97%)—Buy signal effective 5/20/25.

International TTI: +10.67% above its M/A (prior close +10.07%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli