- Moving the market

The markets kicked off Thursday in rally mode, powered by tech stocks, after President Trump rolled out new chip tariffs that carve out big exemptions for companies building in the U.S.

Trump’s late-Wednesday announcement called for a 100% tariff on imported chips, but major players like Nvidia and AMD got a boost, since domestic investment gets a pass—Nvidia popped nearly 2%, AMD soared 5%, and the VanEck Semiconductor ETF (SMH) rose 2%.

Apple joined the tech parade, adding 2% after announcing another $100 billion of spending on U.S. companies and suppliers, on top of its previous $500 billion pledge.

Despite “reciprocal” tariffs officially kicking in, investors seemed content early on, as fresh economic data (like lower-than-expected jobless claims) suggested the economy’s holding up just fine—even after last week’s disappointing July jobs numbers.

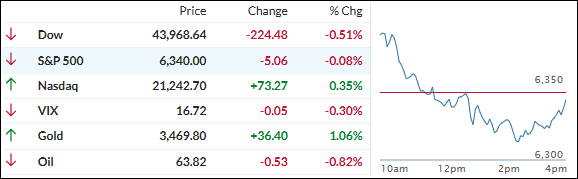

The good vibes didn’t last: Midday, the mood flipped, dragging the Dow and S&P 500 into the red by the close, while the Nasdaq bucked the trend and finished higher. Some traders chalked it up to classic “pumping and dumping,” with semiconductors and mega cap stocks both getting whipsawed.

Elsewhere, a rough 30-year Treasury auction sent bond yields higher, the dollar clawed its way back from yesterday’s lows, and gold hit a two-week high, offering relief for precious metal investors.

Bitcoin was also on the rebound, rallying above $117,000 amid word from the White House that 401ks and private investors will soon get easier access to crypto.

With today’s choppy action and headlines swirling, are the market’s building energy for a breakout, or are we stuck in this sideways grind a little longer?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Stocks did an about-face midday, with the S&P 500 and Dow giving up early gains and sliding into the red.

The Nasdaq managed to go its own way, inching out a modest gain by the close. Gold had a standout session, jumping 1.11% and outpacing most major assets.

Our TTIs showed a mixed bag: the international TTI finished higher, while the domestic one dipped slightly.

This is how we closed 08/07/2025:

Domestic TTI: +3.52% above its M/A (prior close +3.58%)—Buy signal effective 5/20/25.

International TTI: +8.32% above its M/A (prior close +7.90%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli