- Moving the market

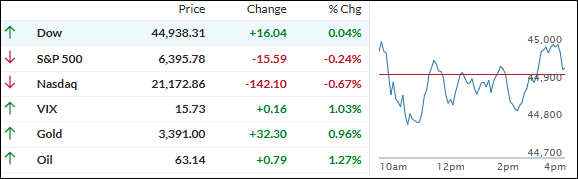

Wall Street got off to a rocky start today, with major indexes slipping again. Tech stocks took a hit for the second straight day, dragging the market lower as traders kept a close eye on mixed retail earnings and anticipated the latest word from the Federal Reserve.

Investors kept cashing out of big-name tech and chip stocks, worried about whether those high price tags—and the AI frenzy backing them—have maybe gone a bit too far.

Nvidia slumped around 3%, while AMD and Broadcom lost more than 3.5%. Over in software and semis, Palantir slid 5.5% and Intel dropped over 6%. Even the mega-cap crew—Apple, Amazon, Alphabet, and Meta—couldn’t find any traction.

On the retail front, Target’s stock tanked over 8% (the S&P 500’s biggest loser of the day) after reporting yet another sales drop and announcing a new CEO starting Feb. 1. Lowe’s, on the other hand, got a little love when its earnings beat estimates.

While traders scooped up some classic retail favorites, no one wanted to touch the so-called “Mag7” tech heavyweights, sending that group sharply lower. Despite the tech slump, the overall market stayed relatively steady.

Bond yields edged down, the dollar pulled back, and gold caught a bid—rising 1% as dip buyers swooped in. Bitcoin bounced back above $114,000 after taking a beating lately, suggesting it might have hit bottom.

But you could almost forget all that—because at the end of the day, everyone’s just waiting to see what Fed Chair Powell will say after Friday’s big symposium in Wyoming.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

It was another day filled with uncertainty on Wall Street, and the Nasdaq caught most of the downside, as traders stayed mostly bearish on tech.

By the closing bell, only the Dow managed to squeak out a small gain—everyone else was stuck in the red.

Our TTIs also moved lower, but just barely—showing that while sentiment is soft, the selloff hasn’t gotten out of hand.

This is how we closed 08/20/2025:

Domestic TTI: +5.52% above its M/A (prior close +5.62%)—Buy signal effective 5/20/25.

International TTI: +10.17% above its M/A (prior close +10.20%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli