- Moving the market

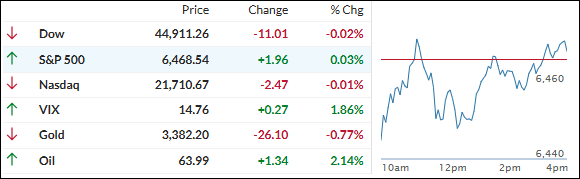

Stocks stumbled out of the gate today after a much hotter-than-expected wholesale inflation report rattled traders and threatened the recent rally. The major indexes clawed their way back from early losses but by the closing bell were basically stuck at flat.

The initial slide came right after July’s Producer Price Index (PPI) showed wholesale prices jumping 0.9% for the month—way above the 0.2% economists had forecast, and the biggest monthly jump in three years.

That’s got Wall Street rethinking just how soon—and how much—the Fed might be able to cut rates. Even so, fed funds futures still show nearly 93% odds of a rate cut in September, just a shade lower than before.

Despite the inflation scare, traders rotated back into big tech. Names like Nvidia, Amazon, and Microsoft helped the market recover from its worst levels, with the Mag7 stocks doing the heavy lifting once again.

In the rest of the market, the dollar managed a bounce (though it still looks shaky after recent losses), gold slid below a key technical level, bond yields climbed, and Bitcoin came off last night’s record high but found solid footing around $118,000.

So, was today’s flat finish just a breather before the next big move—or are traders starting to question their conviction after these mixed inflation signals?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The markets opened in the red and just kind of drifted through the day, never finding much direction.

By the close, the major indexes had only managed to claw their way back to about flat.

Our TTIs mirrored that lack of momentum, easing modestly into the red.

This is how we closed 08/14/2025:

Domestic TTI: +5.52% above its M/A (prior close +6.21%)—Buy signal effective 5/20/25.

International TTI: +10.32% above its M/A (prior close +10.46%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli