- Moving the market

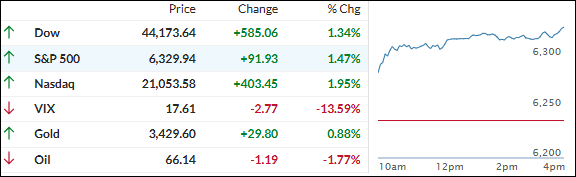

The markets bounced back in style this morning, with all the major indexes recovering a big chunk of Friday’s losses that were sparked by worries about the economy and those new tariffs from the Trump administration.

After a rough end to last week—when weak jobs data, hot PCE inflation, and the final round of mixed earnings all weighed on investor mood—Monday brought a relief rally.

Friday’s slump started with a disappointing jobs report and heavy downward revisions for prior months. That was followed by President Trump firing the head of the Bureau of Labor Statistics and signing an executive order that pushed “reciprocal” tariffs on dozens of countries up to 10–41%.

With little fresh economic news on the calendar this week, traders are keeping close tabs on trade negotiations with China following a meeting between US and Chinese officials in Sweden.

Seasonally, August tends to be rocky—historically the worst month for the Dow and the second worst for the S&P 500 and Nasdaq—but some optimistic traders are hoping this time will buck the trend.

Heavy shorted stocks snapped back sharply today, rebounding right alongside the major indexes.

Lower bond yields helped keep the dollar in check, which gave gold more room to run—crossing above its 50-day moving average. After a choppy weekend, Bitcoin found its footing and bounced back toward $115,000.

So, with the calendar working against the bulls but today’s rally showing signs of life, will August stick to its usual script—or could this time really be different?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The bulls wasted no time taking control after the opening bell today, and they kept the momentum going straight through the close.

The major indexes posted strong gains, while alternative assets—including gold, silver, and copper—joined the rally as well.

Our TTIs moved higher too, just as you’d expect on a day like this.

This is how we closed 08/04/2025:

Domestic TTI: +4.10% above its M/A (prior close +2.84%)—Buy signal effective 5/20/25.

International TTI: +7.00% above its M/A (prior close +6.17%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli