- Moving the market

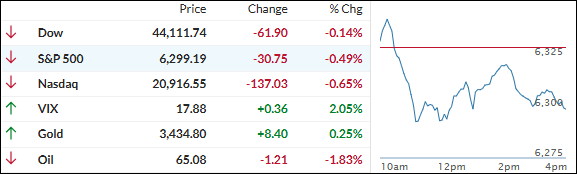

Stocks slipped across the board on Tuesday as traders reacted to some surprisingly weak economic data and fresh tariff talk from President Trump.

Earnings painted a mixed picture—Palantir jumped 8% after hitting a billion dollars in revenue for the first time, but Caterpillar stumbled on an earnings miss.

The big drag on the market came from the ISM Services index, which showed flat growth in July along with signs of higher inflation and shrinking employment. Since services make up about 70% of the U.S. economy, that hit a nerve—any slowdown here could spell trouble down the road.

Adding to the cautious mood, Trump announced upcoming tariffs on chips and pharmaceuticals, saying he wants more of both made in the U.S., with specifics promised “within a week or so.”

That did nothing to calm investors, especially as tech stocks lagged and an early short squeeze fizzled out. Small Caps managed to end modestly in the green, but the Magnificent Seven led the market lower. Meanwhile, bond yields offered no help, finishing the day mixed.

With inflation jitters creeping in, gold ticked higher, the dollar didn’t budge much, and Bitcoin had a rough day before bouncing back to around $113,000.

ZeroHedge noted that Bitcoin’s run of outperforming gold seems to have stalled. Could it be time for precious metals to shine again?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

A fresh round of disappointing economic data and more tariff headlines quickly erased yesterday’s market momentum, pulling stocks broadly lower.

Small caps managed to squeeze out a gain, but the Nasdaq took the biggest hit.

Our TTIs were a mixed bag: the international TTI actually edged higher, while the domestic one slipped. For now, though, our overall outlook hasn’t changed.

This is how we closed 08/05/2025:

Domestic TTI: +3.81% above its M/A (prior close +4.10%)—Buy signal effective 5/20/25.

International TTI: +7.14% above its M/A (prior close +7.00%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli