- Moving the market

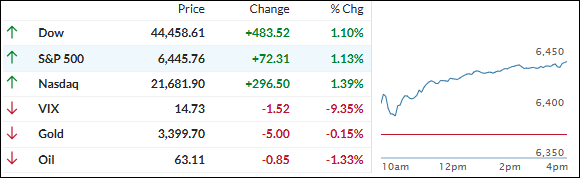

Stocks ripped higher right out of the gate after a cooler CPI print eased worries that tariffs would juice inflation and spoil the party.

Headline CPI came in at 2.7% year over year vs. 2.8% expected, and core was 3.1% vs. 3.0%—not perfect, but “good enough” for a relief rally. Rate-cut odds for next month ticked up, and traders are now leaning toward multiple cuts into year-end.

Tariff headlines are still buzzing, even with a 90-day pause on higher China levies, but the market basically shrugged.

A big short squeeze helped, with the Mag 7 and the rest of the S&P 500 actually moving together for once.

The dollar dumped on the CPI surprise, gold weirdly went nowhere, bond yields whipsawed (down on the print, then back toward flat), and Bitcoin inched higher without breaking out.

So, with inflation cooling just enough to calm nerves, is this the start of the next leg up—or do tariffs, valuations, and late-summer chop still have a say?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

A cooler-than-expected CPI report lit a fire under the bulls today, sending stocks sharply higher by the close.

Small caps led the charge, but gains were broad-based across the major indexes.

Our TTIs moved right along with the market, snapping out of their recent sideways drift, and posting solid advances.

This is how we closed 08/12/2025:

Domestic TTI: +4.72% above its M/A (prior close +3.40%)—Buy signal effective 5/20/25.

International TTI: +9.54% above its M/A (prior close +8.47%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli