- Moving the market

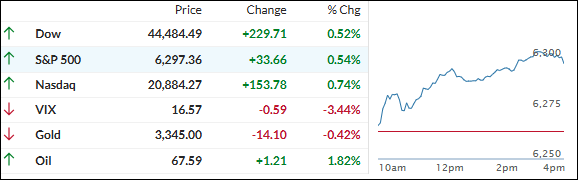

The stock market kicked off today with a dose of optimism, backed by fresh economic data and a string of positive earnings announcements.

Traders were clearly in a good mood, as about 88% of the 50 S&P 500 companies that reported this week managed to top expectations, giving confidence another solid boost.

On the economic front, jobless claims for the week ending July 12 dropped by 7,000 to 221,000—not an earth-shattering move, but it’s the right direction.

Even better, June retail sales jumped 0.6% from May, blowing past the 0.2% forecast. That strong retail report helped push markets higher throughout the day, with the S&P 500 and Nasdaq both setting new records, and small caps leading the charge.

The action wasn’t just about stocks. The most shorted names added extra rocket fuel to the rally, even as bond yields kept to a tight range.

Meanwhile, after yesterday’s dip, the dollar rebounded and clawed back some of its losses. Gold had a wild ride overnight—dropping hard but then finding its feet around the $3,330 mark before ending the day lower.

Bitcoin wasn’t left out of the drama either, taking a tumble before bouncing back to about $120,000.

It’s clear that equities had a strong session, but in the background, everyone’s wondering the same thing: With the economy overall showing mixed signals, when will Fed Chair Powell finally budge and cut rates?

That’s the big unknown keeping traders on their toes.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The bulls had the upper hand today, keeping stocks on a steady climb and pushing all the major indexes to a solid green finish.

There wasn’t much hesitation—just a clear path higher as buyers stayed in control from start to close.

Our TTIs were totally in step with the action, both chalking up gains alongside the broader market.

This is how we closed 07/17/2025:

Domestic TTI: +4.73% above its M/A (prior close +3.88%)—Buy signal effective 5/20/25.

International TTI: +8.14% above its M/A (prior close +7.76%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli