- Moving the market

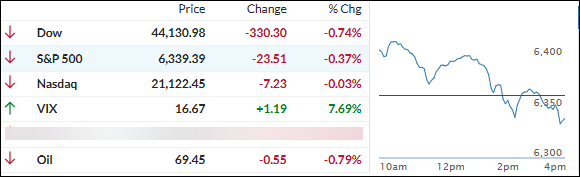

Stocks got off to a hot start on Thursday, with Microsoft and Meta’s blockbuster earnings pushing the S&P 500 and Nasdaq to fresh record highs early on.

Microsoft jumped 6% and Meta rocketed up 11.5% after both tech giants smashed expectations—Microsoft’s cloud business hit over $75 billion in annual revenue, and Meta posted both strong results and upbeat guidance for next quarter.

Traders were also eyeing a key trade deadline and some upbeat talk from Treasury Secretary Scott Bessent, who suggested the U.S. and China might finally be closing in on a trade deal—though he didn’t give any specifics.

But despite all that early excitement, the mood soured as the day went on. The major indexes lost steam and wound up closing in the red, as bearish sentiment took over later in the session.

Looking at the month, the S&P 500 squeezed out a 3.13% gain and the Nasdaq rose an even stronger 4.77%. The “Magnificent Seven” stocks have easily cleared what was a pretty low bar for Q2 earnings, especially in AI-related sectors—though market enthusiasm faded by the end of the day.

Elsewhere, bond yields climbed, boosting the dollar to its first positive month since December. Gold stayed flat for a third-straight month even after testing near record highs but managed a solid 0.66% gain today.

Bitcoin started the month strong with a new record, but spent the back half stuck around $118k. The most shorted stocks got squeezed for much of July before finally cooling off in the final week.

All in all, it’s been a volatile but mostly positive month for markets.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The session got off to a strong start, thanks to blowout earnings from Microsoft and Meta that sent both stocks soaring early on.

But that upbeat mood didn’t last—by midday, bearish sentiment rolled in, wiping out all those early gains and pushing the major indexes firmly into the red by the close.

Our TTIs weren’t spared either, slipping lower to wrap up the final trading day of July.

This is how we closed 07/31/2025:

Domestic TTI: +4.13% above its M/A (prior close +5.09%)—Buy signal effective 5/20/25.

International TTI: +7.18% above its M/A (prior close +8.06%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli