- Moving the market

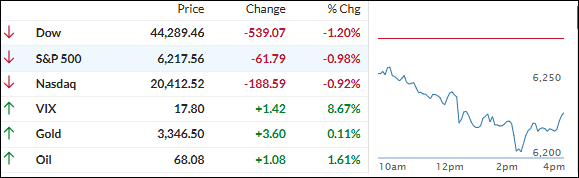

Markets stumbled out of the gate today, weighed down by the same old story—trade uncertainty.

Despite Treasury Secretary Bessent teasing some upcoming announcements within the next 48 hours, he left out key details like which countries might be involved. That didn’t do much to calm nerves, especially with Trump’s 90-day tariff pause set to expire this week.

Adding fuel to the fire, Trump floated the idea of slapping an extra 10% tariff on countries aligned with BRICS, calling them out for “Anti-American policies.” That didn’t sit well with traders.

By the end of the day, the market stayed underwater. Gold was the lone bright spot, bouncing back midday to finish slightly in the green.

On the equity side, Small Caps took the biggest hit, while the S&P 500 held up a bit better. Mega Caps gave back a good chunk of Thursday’s gains, and Tesla slid after Elon Musk announced plans to launch a new political party.

Bond yields ticked higher, giving the dollar a boost. Gold managed to hold its ground, and Bitcoin followed a similar path—starting strong but fading by the close.

Historically, July has averaged a +1.67% return going all the way back to 1928. So, the big question is: Will history repeat itself this time around?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

It was a rough day for the bulls—optimism was nowhere to be found as ongoing trade tensions kept traders on edge.

The market tried to stage a small comeback late in the session, but it wasn’t enough. All the major indexes stayed in the red and wrapped up the day with losses.

Our TTIs also pulled back a bit from their recent highs. But the dip wasn’t deep enough to shake our current positive outlook—so for now, the bigger picture still looks intact.

This is how we closed 07/07/2025:

Domestic TTI: +4.63% above its M/A (prior close +5.49%)—Buy signal effective 5/20/25.

International TTI: +8.76% above its M/A (prior close +9.69%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli