- Moving the market

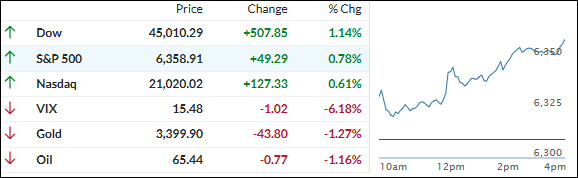

Stocks got a jolt this morning after President Trump announced a trade deal with Japan, sending the Dow up more than 200 points out of the gate.

Hopes are running high that this “massive” agreement, which introduces a 15% tariff on Japanese goods instead of the 25% that was originally on the table, could spark even more deals down the road. Trump also mentioned ongoing talks with the EU, aiming for another breakthrough before the August 1 deadline.

The S&P 500 followed the Dow’s lead, but the Nasdaq took its time, barely moving until it finally got a lift later in the session.

All eyes are now on Alphabet and Tesla, with both set to report earnings after the closing bell. As the first of the mega-cap techs to release results, their numbers could set the tone for the rest of earnings season.

Elsewhere, market sentiment brightened thanks to the Japan deal, even though U.S. existing home sales fell short of expectations and took some wind out of the macro surprise index.

The most shorted stocks had a wild ride but ended up helping the broader market, despite rising bond yields.

The dollar continued to slide, but that didn’t give a boost to gold this time, which ended the day lower. Bitcoin dipped but found its footing at around $118,000.

With so much riding on the next big earnings reports, will tomorrow’s market direction hinge on how Alphabet and Tesla perform after the bell?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The Nasdaq got off to a slow start today but eventually found its footing, climbing out of negative territory and closing in the green.

That said, it still trailed behind the stronger performances from both the Dow and the S&P 500.

Our TTIs moved higher along with the broader market. Interestingly, today marked a reversal from yesterday’s pattern—this time, it was the international TTI that outpaced its domestic counterpart.

This is how we closed 07/23/2025:

Domestic TTI: +6.46% above its M/A (prior close +5.59%)—Buy signal effective 5/20/25.

International TTI: +10.44% above its M/A (prior close +8.75%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli