- Moving the market

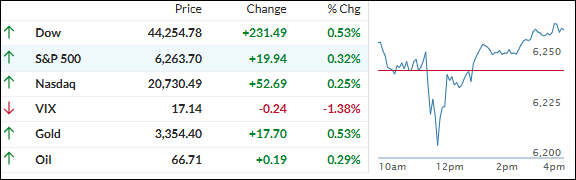

The markets started the day in neutral, with the major indexes barely budging as traders waited on earnings from the big banks and tried to make sense of the latest inflation data.

Bank of America, Goldman Sachs, and Morgan Stanley all beat expectations, but their stock reactions were all over the place—some up, some down.

Meanwhile, June’s Producer Price Index (PPI), which gives us a sneak peek at inflation trends, came in flat. That’s a surprise, especially since many were bracing for a bump thanks to tariffs. So far, no sign of “tariff-flation.”

On the economic front, Industrial Production came in hotter than expected—up 0.3% month-over-month, which adds up to a 0.73% gain year-over-year. That’s a solid beat.

Despite the good news, markets didn’t seem too impressed. Investors were more focused on whether the Fed might have room to cut rates later this year.

The day wasn’t without drama. Stocks briefly tanked after reports from CBS and the New York Times claimed Trump was planning to fire Fed Chair Powell—rumors that were quickly denied.

That sparked a wild ride in the markets, with a big short squeeze helping stocks bounce back. Bond yields, rate-cut bets, the dollar, and gold all swung wildly too.

Gold managed to finish higher, while Bitcoin quietly kept climbing, seemingly tracking global liquidity trends.

So, with all this noise, are the markets gearing up for a breakout—or just catching their breath?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Wall Street was on a wild ride today, with bulls and bears battling it out. But by the closing bell, the bulls came out on top, pushing the major indexes into the green led by a strong performance from the Dow.

Our TTIs rode the wave too, climbing further into bullish territory and signaling growing market confidence.

This is how we closed 07/16/2025:

Domestic TTI: +3.88% above its M/A (prior close +3.48%)—Buy signal effective 5/20/25.

International TTI: +7.76% above its M/A (prior close +7.59%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli