- Moving the market

The markets kicked off the week on a down note, thanks to renewed tariff threats from Trump—this time aimed at the E.U. and Mexico with a hefty 30% rate. That stirred up some uncertainty about the economic impact, but the dip was fairly mild, as many traders believe those tariffs will eventually get negotiated down.

All eyes are now on inflation data due later this week, which should give Wall Street a clearer picture of how existing tariffs are rippling through the economy.

Starting tomorrow, the big banks will start reporting earnings, kicking off a busy week of financial updates. Expectations are generally solid—but the big question is: will strong earnings be enough to distract from the tariff drama?

Meanwhile, Bitcoin didn’t seem to care about any of that. It rallied hard over the weekend, smashing through the $123K mark before cooling off a bit to settle near $120K.

It’s still riding the wave of global liquidity and continues to cement its status as the best-performing asset of the past decade—maybe even of all time.

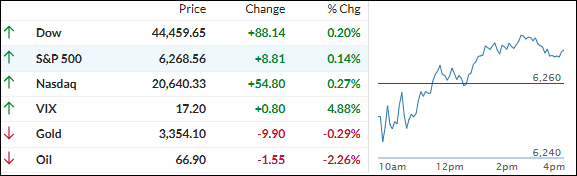

By the end of the day, the major indexes managed to claw their way into the green. Short sellers got squeezed, but interestingly, the Magnificent 7 stocks lagged the rest of the S&P 500.

Bond yields drifted slightly higher, gold gave up early gains to close down 0.32% (but held support at $3,350), and oil had a wild ride—first pumping, then dumping.

So, with earnings season heating up and inflation data on deck, what’s going to move the needle next?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The markets started off on a shaky note, dipping into the red early on. But as the day went on, they found their footing, clawed back the losses, and managed to close with a modest gain.

Our TTIs were a bit all over the place too—the domestic TTI squeezed out a small gain, while the international one ended about unchanged.

This is how we closed 07/14/2025:

Domestic TTI: +4.93% above its M/A (prior close +4.83%)—Buy signal effective 5/20/25.

International TTI: +8.39% above its M/A (prior close +8.38%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli