- Moving the market

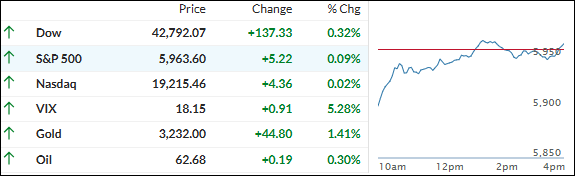

The major indexes opened in negative territory as markets reacted to Moody’s decision to downgrade the U.S. credit rating from AAA to Aa1. The move was driven by mounting concerns over the ballooning federal deficit and the challenges of refinancing government debt at higher interest rates.

This downgrade immediately pressured bond prices, sending yields sharply higher as investors demanded greater compensation for increased risk. Early session uncertainty was further compounded by lingering questions about the full impact of recent tariff policies on the broader economy.

Despite these headwinds, sentiment gradually improved throughout the day. As the session progressed, bond yields reversed course and dipped, while equities clawed back their losses and managed to close slightly in the green.

In the commodities space, gold rallied strongly, approaching the $3,250 level as investors sought safe-haven assets amid fiscal uncertainty and rising debt.

The dollar, meanwhile, weakened, falling back to last week’s lows, while Bitcoin experienced notable volatility, swinging from $107,000 to $102,000 before rebounding to $105,000.

Today’s market action confirmed our new domestic “Buy” signal, effective tomorrow, May 20. In anticipation, I took advantage of the early dip to establish new positions for client portfolios.

With the U.S. credit rating now downgraded and fiscal challenges mounting, will this rebound in equities prove sustainable, or are markets underestimating the long-term risks posed by rising debt and elevated borrowing costs?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The markets opened lower today, reacting to the negative sentiment following Moody’s downgrade of the U.S. credit rating. Despite this initial setback, equities quickly rebounded, erasing early losses, and finishing the session slightly in positive territory.

Our “Buy” signal has now been officially confirmed, effective tomorrow, May 20th. In anticipation of this shift, I proactively added new positions to client portfolios earlier in the session as the indexes began to recover.

This is how we closed 05/19/2025:

Domestic TTI: +2.50% above its M/A (prior close +2.51%)—Sell signal effective 4/4/25.

International TTI: +6.25% above its M/A (prior close +5.94%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli