- Moving the market

Nvidia lit the fuse this morning with a strong earnings report, but the rally didn’t quite explode.

While the chip giant’s results gave markets an early boost, excitement faded as traders turned their attention to trade policy uncertainty.

A federal court ruling struck down Trump’s “reciprocal” tariffs, saying he overstepped his authority—raising fresh doubts about how future trade negotiations might unfold.

Some analysts brushed it off as a “nothingburger,” and the market seemed to agree, ending the day with modest gains.

Looking at the broader picture, the April/May short squeeze appears to be losing steam.

Nvidia gave back more than half of its post-earnings pop, bond yields dipped (with the 7-year hitting a two-week low), and rate-cut expectations shifted—up for 2025, down for 2026.

The dollar softened, gold flirted with $3,350 but didn’t quite get there, and Bitcoin stumbled after an early surge, sliding toward $106K despite continued ETF inflows.

So, the big question now is: will tomorrow’s PCE inflation reading be soft enough to give the market a fresh reason to rally?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

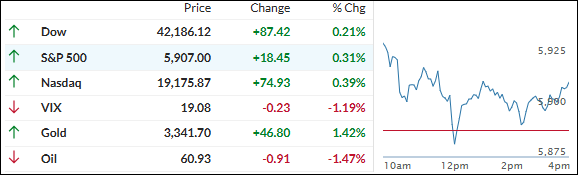

An early rally fizzled out, with the S&P 500 slipping below the flat line before bouncing back to finish slightly in the green. The other major indexes followed a similar rollercoaster—up early, down midday, and a modest recovery by the close.

Meanwhile, our TTIs were more stable throughout the day, both posting modest gains without much drama.

This is how we closed 05/29/2025:

Domestic TTI: +0.49% above its M/A (prior close +0.24%)—Buy signal effective 5/20/25.

International TTI: +6.20% above its M/A (prior close +5.67%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli