- Moving the market

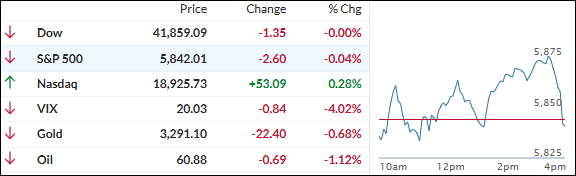

Early trading saw two of the major indexes fluctuating near their unchanged lines, while the Nasdaq stood out with a clear upward move, reflecting pockets of bullish sentiment.

The market’s attention was firmly on the passage of a sweeping tax and spending bill in the House, which aims to lower taxes and boost military spending but is projected to add trillions to the U.S. deficit over the next decade.

The 30-year bond yield responded by climbing to its highest level since October 2023, as investors weighed the implications of higher government borrowing and fiscal expansion.

The bill, which now heads to the Senate, has sparked debate among lawmakers and analysts. While some argue that the tax cuts and increased spending could offer a short-term boost to the economy, many warn that the resulting surge in deficits will likely stoke inflation and drive bond yields even higher, making bonds less attractive as an investment.

This uncertainty, combined with ongoing questions about the impact of tariff policies, contributed to early weakness in equities.

Midday, the indexes attempted a rebound but quickly hit resistance, with both the Dow and S&P 500 ending the session flat despite bond yields easing off their highs.

Gold’s initial rally faded by the close, while Bitcoin saw significant volatility—setting a record but falling short of the $112,000 mark.

As noted by ZeroHedge, much of the recent Bitcoin movement has been driven by institutional investors, with the retail crowd largely sitting on the sidelines. This dynamic raises a key question:

Can renewed retail participation be ignited again, or will institutions continue to dominate trading activity?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

An early rally quickly lost steam, with the major indexes reversing course and struggling to sustain positive momentum throughout the session. By the close, the markets ended largely unchanged, with neither significant gains nor losses.

Our TTIs mirrored this lackluster performance. The domestic TTI slipped slightly below its trendline, but this minor dip has not altered our overall bullish outlook at this time.

This is how we closed 05/22/2025:

Domestic TTI: -0.31% below its M/A (prior close +0.01%)—Buy signal effective 5/20/25.

International TTI: +5.34% above its M/A (prior close +5.95%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli