- Moving the market

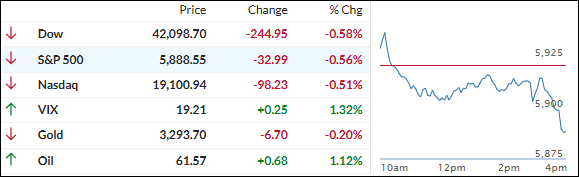

The markets treaded water today as investors played the waiting game ahead of some big news—most notably, Nvidia’s earnings report and the latest Fed meeting minutes.

Nvidia is set to report after the bell, and traders are watching closely, especially with growing concerns about how U.S. restrictions on chip sales to China might impact the AI giant. So far, demand for its powerful GPUs hasn’t shown signs of slowing down.

As for the Fed minutes? Pretty much a non-event. The language was vague, and there was no clear signal on what’s next for interest rates.

But just when it looked like the market might find its footing, news broke that the White House is pushing chipmakers to halt sales to China.

That sent a chill through the markets—stocks dipped, bond prices fell, gold and bitcoin slid, and the dollar was the only one left standing.

Now, all eyes are on Nvidia. Can its earnings turn things around tomorrow?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

It was a rough day in the markets. Uncertainty took the wheel, and bearish vibes stuck around from open to close, dragging the major indexes into the red.

Even the usual safe havens—gold and bitcoin—couldn’t hold their ground and slipped lower.

Our TTIs weren’t immune either—they followed the broader trend and pulled back as well.

This is how we closed 05/28/2025:

Domestic TTI: +0.24% above its M/A (prior close +1.10%)—Buy signal effective 5/20/25.

International TTI: +5.67% above its M/A (prior close +6.31%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli