- Moving the market

Positive news on tariffs boosted the markets early on, as Trump’s unexpected tariff exemption for tech devices lifted equities alongside lower bond yields.

Smartphones, computers, and components like semiconductors were excluded from the new reciprocal levies, according to guidance issued last Friday. Tech giants such as Apple, Nvidia, Intel, and Dell saw significant gains, with the entire tech sector (XLK) rising by approximately 2%.

However, these exemptions are not permanent and may still be subject to the existing 20% Fentanyl tariffs, merely shifting to a different “tariff bucket.” Nonetheless, traders welcomed the news for the day.

Despite last week’s rally, the three major indexes remain sharply down since the reciprocal tariffs were announced, as uncertainty continues to influence the long-term trend.

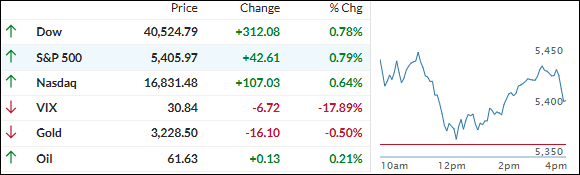

Today saw another volatile session with an early bounce fading, but upward momentum returned, leading to a positive close. The last 10 minutes, however, experienced heavy selling pressure, as noted by ZH.

Additionally, the S&P 500 triggered a “death cross,” a bearish signal where the 50-day moving average crosses below the 200-day moving average.

The Mega-cap sector posted moderate gains, bond yields retreated, and rate-cut expectations increased. The dollar and gold slipped moderately, while Bitcoin rallied above $85k despite some intraday volatility.

Will the upcoming earnings season help stabilize market volatility?

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

Despite suffering a midday dip, the major indexes managed to recover and closed the session in positive territory.

Our TTIs also participated in the intraday fluctuations, closing higher, although they remain entrenched in bearish territory.

This is how we closed 04/14/2025:

Domestic TTI: -6.24% below its M/A (prior close -7.42%)—Sell signal effective 4/4/25.

International TTI: -2.05% below its M/A (prior close -3.65%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli