- Moving the market

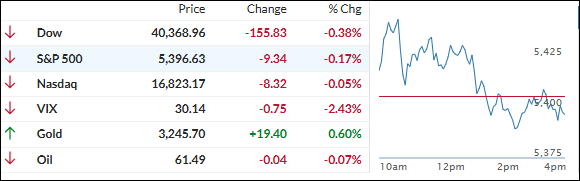

The major indexes cautiously advanced early on as traders analyzed the latest earnings reports and enjoyed a decline in market volatility, indicated by a drop in the VIX.

Yesterday, tech stocks received a boost following revelations of exemptions from reciprocal tariffs for electronic products such as smartphones, computers, and semiconductors. Even though later clarifications suggested these exemptions might be temporary, the bulls continued to push the indexes higher.

While equities are still recovering from losses incurred after Trump’s original tariff announcement, concerns persist that more headline-driven volatility could disrupt the current rebound at any time.

Ultimately, the initial short squeeze faded as anxiety grew, leading the major indexes to close moderately in the red, while the S&P 500 “death cross” remained in play.

The mega-cap sector continued its slide despite lower bond yields, but the dollar managed to eke out a modest gain. Bitcoin rallied to $86k before retreating to the $84k level, while gold ignored the dollar’s strength and climbed to around $3,250.

Interestingly, as ZH pointed out, SmallCaps have never been this low relative to the Nasdaq, yet the S&P 500 remains far from the prior valuation levels that marked a low.

Does this mean new lows are still on the horizon?

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

Early market optimism waned by midday, leading to the major indexes turning negative in the afternoon.

Our TTIs closed the day with mixed results: the international TTI edged higher, while the domestic TTI declined. Despite these movements, our bearish outlook remains unchanged.

This is how we closed 04/15/2025:

Domestic TTI: -6.54% below its M/A (prior close -6.24%)—Sell signal effective 4/4/25.

International TTI: -1.66% below its M/A (prior close -2.05%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli