- Moving the market

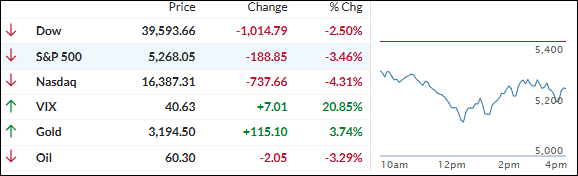

Equities resumed their downward trend after yesterday’s historic rebound, which was triggered by Trump’s 90-day pause on some reciprocal tariffs. The EU followed suit by announcing a similar pause on U.S. goods.

Despite this, a 125% tariff rate on goods from China remains, with Trump expressing optimism that “a very good deal” can still be achieved. However, the markets may not be out of the woods yet. While the delay might provide some relief, it does not reduce uncertainty, and market volatility is expected to remain high.

This morning, the tech sector experienced the steepest declines, with major players like Apple, Tesla, Nvidia, and Meta pulling back sharply. This follows the S&P 500’s 9% gain yesterday, its third-largest single-day increase since World War II.

The major indexes retraced more than half of yesterday’s gains before cutting losses somewhat by midday, as the dollar weakened, and yesterday’s short squeeze showed no follow-through.

Global uncertainty pushed gold prices to a record high, marking its biggest two-day gain since the COVID-19 pandemic. Conversely, Bitcoin gave up some of yesterday’s gains but managed to retake the $80k level, while bond yields closed higher.

This period of uncertainty, volatility, and confusion is underscored by the dollar being at its lowest in two years, while gold sits at a record level.

This is a good time to watch this debacle from the sidelines.

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

Hopes for a sustained rebound from yesterday were quickly dashed as the major indexes opened in the red and bullish sentiment failed to gain traction throughout the session.

Although equities managed to recover slightly from their intraday lows, they ultimately closed in negative territory.

Our TTIs showed mixed results: the international TTI saw a slight improvement, while the domestic TTI exhibited increased weakness.

This is how we closed 04/10/2025:

Domestic TTI: -8.86% below its M/A (prior close -5.69%)—Sell signal effective 4/4/25.

International TTI: -4.54% below its M/A (prior close -5.38%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli