- Moving the market

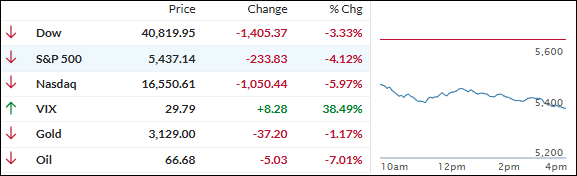

Last night, the futures market experienced a pump-and-dump, reflecting the market’s reaction to Trump’s tariff policies. This morning, the sell-off continued, with major indexes and the broader market dropping sharply.

As a result, our domestic TTI entered “Sell” mode, and I liquidated our last domestic position in my advisory practice. We are now holding only a few selected sector ETFs.

The sell-off was broad, affecting most asset classes, including those considered “safe” havens. Many traders are highly leveraged, and when margin calls arrive, they liquidate any assets they own to meet requirements.

Trump’s tariffs were extensive but only covered about half of the tariffs imposed on the U.S. for decades. Despite not being fully reciprocal, traders and algorithms viewed them negatively due to the potential risks of a global trade war amid a slowing U.S. economy.

At the NY Stock Exchange, decliners outnumbered advancers by six to one. Shares of multinational companies like Nike (-15%) and Apple (-9%) were hit hardest, while global stock markets slumped 3% overnight.

The S&P 500 suffered its biggest daily loss since June 2020, closing at its lowest point of the day. Small Caps fell to their lowest level since January 2024, and Mega Cap tech stocks dropped to their lowest level since September.

Banks were heavily impacted, the dollar fell below its 200-day moving average, and crude oil lost nearly 7%. Bitcoin gave back its recent gains, gold fluctuated but remained above $3,100. Despite a drop in bond yields, it wasn’t enough to support the markets.

With uncertainty about market direction prevailing, it’s wise to stay on the sidelines in the safety of money market funds until a new bull market can be identified.

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended today. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI below its trend line since March 10, 2025, but not enough to end the Buy cycle—until today. As a result, we have exited the domestic market.

Meanwhile, our International TTI remains in Buy mode but is showing signs of weakness. I anticipate that it may also break down soon.

3. Trend Tracking Indexes (TTIs)

Trump’s tariff announcement yesterday afternoon triggered widespread selling in the overnight futures market, which continued throughout the day session. The sell-off was broad, with dip buyers notably absent, leading the S&P 500 to close at its lowest point of the day.

Our TTIs dropped sharply, with the international TTI barely remaining positive. The domestic TTI plunged and finally broke below its trend line by a significant margin, signaling the end of the current Buy cycle for broadly diversified domestic equity ETFs.

We will now stay on the sidelines until a new uptrend is detected. For tracking purposes, the effective date of this Sell signal is April 4, 2025.

This is how we closed 04/03/2025:

Domestic TTI: -4.97% below its M/A (prior close -0.22%)—Sell signal effective 4/4/25.

International TTI: +0.24% above its M/A (prior close +3.45%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli