- Moving the market

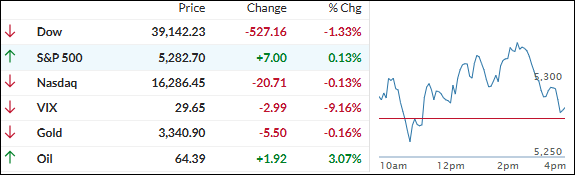

An early bounce quickly faded, leading equities to slip into the red on the last trading day of the week. The S&P 500 was the exception, managing to eke out a fractional gain.

The Dow suffered the most, primarily due to United Health (UNH) plummeting by 22% at one point after missing earnings expectations. Chipmaker Nvidia also retreated, dropping another 3.7% following yesterday’s quarterly charge of $5.5 billion related to its graphics processing units.

Adding to the bearish sentiment was Fed Chair Powell’s stance on Trump’s tariff policies, which he believes could drive up inflation in the near term and “is likely to move us further away from our goals.”

This contrasts sharply with his decision to cut rates last year when financial conditions were looser, as opposed to the tightened conditions now. Perhaps Powell is focusing on the strength in hard data rather than the soft data that tumbled this week.

The major indexes closed out another week to the downside, with markets closed tomorrow for Good Friday. Since Liberation Day, the major indexes are still down 7-8%, while the Mega-cap sector has been down 8 of the last 9 weeks.

Bond yields ended the week lower, and the dollar tumbled for the third straight week to its lowest level since the first week of October, as noted by ZH. This decline benefited gold, which surged to record highs.

Bitcoin gained for the second straight week but remains stuck at its 50-day moving average for now. However, historical liquidity suggests it might be poised for another significant rise.

Enjoy the Easter weekend.

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

The Dow faced significant selling pressure throughout the session. In contrast, the Nasdaq experienced only a slight decline, and the S&P 500 managed to close in positive territory.

Meanwhile, our TTIs both posted gains, reducing the gap to their respective trend lines.

This is how we closed 04/17/2025:

Domestic TTI: -7.00% below its M/A (prior close -7.74%)—Sell signal effective 4/4/25.

International TTI: -1.82% below its M/A (prior close -2.19%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli