- Moving the market

Equities pulled back early as traders anxiously awaited more clarity from Trump regarding his tariff policy rollout tomorrow.

Additional market pressure came from weak economic data, with manufacturing moving into contraction territory (stagflation) and job openings falling slightly below estimates, supporting the early pullback.

However, this downturn was temporary. Bullish sentiment helped the major indexes recover, although uncertainty about tomorrow’s final tariff implementation limited the rebound. Traders seem prepared for a potential relief rally if the outcome is better than expected.

The midday pullback was triggered by the long-awaited answer to when the tariffs would take effect. Press Secretary Leavitt announced they would be implemented “immediately after the announcement,” causing the indexes to dip before a late-hour push higher.

Bond yields slipped, the dollar remained unchanged, gold fluctuated but did not set a record, and Bitcoin surged past $85k, holding that level into the close.

The next directional move in equities now hinges on the interpretation of tomorrow’s tariff announcements.

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

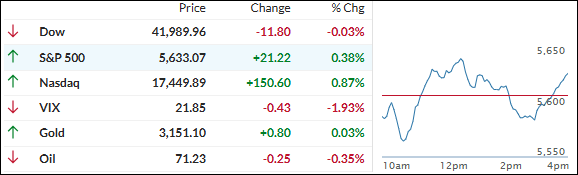

The major indexes wavered throughout the day. The S&P 500 and Nasdaq managed to post small gains, while the Dow ended nearly flat.

Our TTIs showed a slight improvement in relation to their respective trend lines, but they remain in the neutral zone.

This is how we closed 04/01/2025:

Domestic TTI: -1.04% below its M/A (prior close -1.15%)—Buy signal effective 11/21/2023.

International TTI: +3.20% above its M/A (prior close +2.84%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli