ETF Tracker StatSheet

You can view the latest version here.

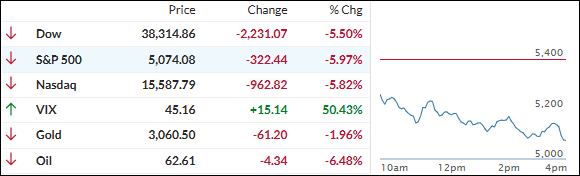

S&P 500 AND MAG7 STOCKS SEE MASSIVE LOSSES, NO SECTOR SPARED

- Moving the market

The major indexes opened sharply lower again today, continuing yesterday’s decline and confirming our “Sell” signal for broadly diversified domestic equity ETFs.

China was the first country to retaliate with tariffs on U.S. goods, further supporting the view that a trade war is imminent, potentially sparking a global recession.

China’s commerce ministry announced a 34% levy on all U.S. products, matching the tariff on Chinese goods entering the U.S. Additionally, several companies were added to China’s “unreliable entities list,” escalating tensions further.

The tech sector was hit hard, with companies like Apple, Nvidia, and Tesla suffering significant losses due to their large exposure to China. Apple, for instance, is down 10% for the week.

Despite dropping bond yields, with the 10-year sliding below 4%, the relentless selling continued. Global stocks faced significant declines, yet China remains the leader year-to-date, while Europe and the U.S. experienced severe losses.

Gold remains the biggest winner year-to-date compared to stocks, crude oil, and the dollar, as positive hard data supports Fed Chair Powell’s comments that “the economy remains on solid footing.” Despite his hawkish stance, rate-cut expectations surged, with the possibility of five cuts.

The Mag7 stocks were also hit hard, losing $1.4 trillion this week and $4.5 trillion in market cap from their highs.

The S&P 500 fared worse, losing $5.5 trillion in the last two days. There was no place to hide, as all sectors, even defensive ones, ended in the red.

Gold, while holding up fairly well, was sold today but managed to defend its $3,000 level successfully. Bitcoin closed higher today and ended the week unchanged, possibly in anticipation of upcoming liquidity changes.

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

The equity market continued its downward spiral today, with indexes opening sharply lower.

Despite some recovery attempts, the S&P 500 closed at the session’s lows, suggesting a challenging start for Monday. The sell-off was widespread, affecting all sectors.

Our TTIs fell further into bear market territory, with the international index also signaling a “Sell.”

This is how we closed 04/04/2025:

Domestic TTI: -10.24% below its M/A (prior close -4.97%)—Sell signal effective 4/4/25.

International TTI: -5.61% below its M/A (prior close +0.24%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli