- Moving the market

Despite intensifying global tensions, the markets edged into the green early on as traders sought a bottom after recent relentless selling.

Optimism persisted even as the European Union (EU) and China announced retaliatory tariffs on U.S. merchandise. China will impose an 84% levy starting Thursday, following U.S. tariffs of 104% on Chinese imports that took effect at midnight. The EU also approved its first set of tariffs on the U.S., starting on April 15.

Other countries joined in, announcing 25% retaliatory tariffs on U.S. vehicles. This ongoing tug-of-war has kept anxiety high on Wall Street, with the 4-day rout likely not over. The Dow has now fallen 19% from its highs.

Everything changed when Trump suddenly announced a 90-day pause on tariffs, initially dismissed as fake news on Monday but confirmed today. His 10% blanket tariff for all countries remains in effect, but he will need more time to negotiate with over 70 countries seeking direct talks.

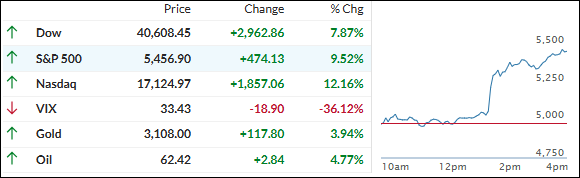

In response, computer algorithms went haywire, pushing major indexes 8-12% higher, with the Nasdaq seeing its largest gain since October 2008. Remarkably, the S&P 500 experienced its largest ever point reversal yesterday, surpassing the record set on October 14, 2008.

While the comeback rally captured attention, the real drama unfolded in the bond market, where chaos reigned as price volatility hinted at potential malfunctions. The basis trade was in danger of blowing up, a complex concept beyond the scope of this summary, but you can read more about it here.

Bond yields spiked, especially the 2-year, the dollar retreated, Bitcoin surged past $82k, and gold had its best day since 2020.

Rate-cut expectations plunged, leaving this wild session with more questions than answers.

2. Current “Sell” Cycle (effective 4/4/25)

Our domestic Buy cycle, which began on November 21, 2023, ended on April 3, 2025. The market reacted negatively to Trump’s tariff policy, causing major indexes and the broader market to drop sharply.

This confirmed the bearish trend that had been pushing our domestic TTI (Trend Tracking Index) below its trend line since March 10, 2025, but it wasn’t enough to end the Buy cycle until now. Consequently, we have exited the domestic market.

Meanwhile, our International TTI dropped sharply on April 4, 2025, generating a “Sell” signal. Since we did not have any exposure in international markets, we were not affected.

3. Trend Tracking Indexes (TTIs)

The session began slowly but positively, eventually turning into an algorithm-driven surge for higher prices following Trump’s announcement of a 90-day reprieve on his tariff policy. All indexes soared and remained significantly elevated by the close.

It remains uncertain whether this was an anomaly. Our TTIs also rose but stayed below their respective trendlines for now.

This is how we closed 04/09/2025:

Domestic TTI: -5.69% below its M/A (prior close -12.67%)—Sell signal effective 4/4/25.

International TTI: -5.38% below its M/A (prior close -8.08%)—Sell signal effective 4/7/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli