- Moving the market

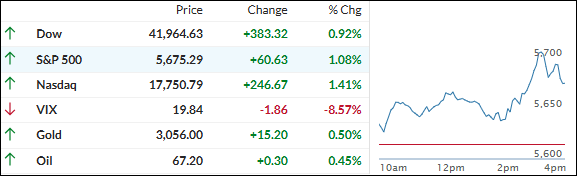

In anticipation of the Fed’s policy announcement, equities climbed higher early in the session and continued their upward trend, joined by bonds, gold, and cryptocurrencies.

While no change in rates is expected, traders are keen to hear the Fed’s outlook on two potential rate cuts this year. They will also be listening for insights on how the Fed evaluates the current economy, given the trade tensions created by tariffs.

Alongside the interest rate decision, Fed Chair Powell commented on GDP, inflation, unemployment, and the possibility of “stagflation.” His remarks were both dovish and hawkish, but traders interpreted them positively, leading to a broad market rally.

Powell also addressed Trump’s tariff agenda, stating that tariff inflation can be transitory if inflation expectations are anchored.

The most shorted stocks were squeezed for the third time in four days, bond yields retreated, rate cut expectations increased, and even the dollar ended slightly higher despite a midday dip.

Gold surged above $3,050, Bitcoin approached $86,000, and crude oil recovered some of its previous losses.

It was a strong comeback day for all markets, with our domestic TTI now close to crossing back above its long-term trend line.

Is the bull market about to resume its trend again?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The market opened positively, with traders hopeful that Fed Chair Powell would meet expectations—and he did.

The broad market saw a strong rally, with most asset classes participating.

Our TTIs also gained, with the domestic TTI now just a fraction away from returning to bullish territory. If this occurs, I plan to monitor market activity for a few days before increasing our domestic holdings.

This is how we closed 03/19/2025:

Domestic TTI: -0.14% below its M/A (prior close -0.85%)—Buy signal effective 11/21/2023.

International TTI: +6.22% above its M/A (prior close +5.77%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli