- Moving the market

The markets showed some early strength following yesterday’s comeback rally, pushing our domestic TTI close to breaking above its long-term trend line.

Traders largely ignored the weak Consumer Confidence data, which revealed a drop in the near-term outlook for income, business, and job opportunities. The index fell to 92.9, below the expected 93.5, with future expectations hitting a 12-year low. Despite this, the markets remained resilient.

The primary focus, however, is on the upcoming tariffs. President Trump suggested that many countries might receive exemptions from reciprocal tariffs, reducing some of the anticipated impact.

By midday, bearish sentiment took over, causing the major indexes to surrender most of their early gains. Nevertheless, the session ended moderately in the green.

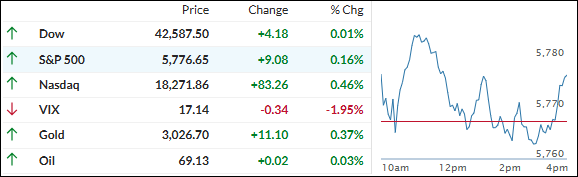

The S&P 500 closed above its widely followed 200-day moving average, while our Domestic TTI remained below its long-term trend line, with bond yields ending the session unchanged.

Gold advanced, Bitcoin remained stable, but the market overall was stuck in a holding pattern, lacking a clear bullish catalyst.

However, we could see significant moves in either direction due to the end-of-quarter rebalancing of pension and target-date funds.

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

Initial bullish sentiment faded by midday, but the major indices managed to close slightly higher.

Our TTIs showed mixed results: the international TTI edged up, while the domestic TTI declined, indicating underlying weakness in the broader market.

This is how we closed 03/25/2025:

Domestic TTI: -0.32% below its M/A (prior close -0.08%)—Buy signal effective 11/21/2023.

International TTI: +5.73% above its M/A (prior close +5.57%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli