- Moving the market

The major indexes took a breather early on after a relentless climb over the past few months, with November standing out as the best performing month of the year.

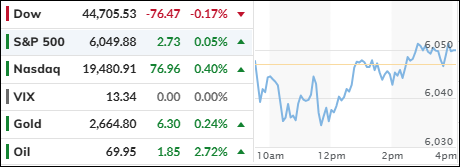

Both the S&P 500 and Nasdaq hit record highs yesterday, continuing their strong post-election gains, with the S&P 500 up 4.6% and the Nasdaq up 5.2%. The Dow also saw a 6% increase since the election. However, Small Caps dropped sharply as the Nasdaq outperformed.

Despite initial bearish pressures, the S&P 500 and Nasdaq managed to eke out small gains by the end of the session. This came after South Korea reversed its martial law announcement, leading to a recovery in the Won currency and a bounce in the Korea ETF EWY from its early lows.

On the economic front, job openings in October were reported at 7.74 million, significantly higher than the expected 7.5 million, marking the largest increase in 14 months. We’ll have to wait and see what the revisions reveal in a few weeks.

Bond yields rose moderately, the Mega Tech basket approached its post-election highs, the dollar fluctuated without clear direction, and gold closed higher but gave back some early gains.

Bitcoin mirrored this pattern, initially surging on the Korean news before pulling back and finding support around the $95k mark. Crude oil outperformed, nearing the $70 level once again.

Will bullish sentiment remain strong enough to turn December into a repeat of November?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The market experienced some turbulence due to upheaval in South Korea, which caused the major indexes to dip from their elevated levels. However, by the end of the session, both the S&P 500 and the Nasdaq managed to recover and close in positive territory.

Our TTIs showed a mixed performance, with the international indicator making gains, while the domestic indicator experienced a slight decline.

This is how we closed 12/03/2024:

Domestic TTI: +9.56% above its M/A (prior close +10.05%)—Buy signal effective 11/21/2023.

International TTI: +5.19% above its M/A (prior close +4.98%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli