- Moving the market

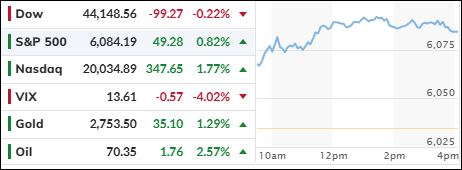

The latest inflation readings provided a boost to the markets, with the S&P 500 and Nasdaq achieving solid gains, while the Dow lagged. The Consumer Price Index (CPI) met expectations, showing a 0.3% rise from October and a 2.7% increase year-over-year. The Federal Reserve’s preferred measure, the core CPI, which excludes volatile food and energy prices, also rose by 0.3% for the month and 3.3% year-over-year.

Although this data indicated a faster pace than the previous month, traders speculated that it wasn’t high enough to prevent the Fed from cutting rates later this month, with the odds of a rate cut now at 99.9%.

Despite the anticipation of rate cuts, bond yields surged as prices dropped, while other assets like stocks, gold, the dollar, crude oil, and cryptocurrencies remained bullish.

The mega tech sector reached a new record high, gaining in 11 of the past 13 days. The dollar advanced for the fourth consecutive day, which typically would have negatively impacted gold, but the precious metal rallied by nearly 1.3% to close above $2,750.

Bitcoin also spiked above $102,000, and crude oil reclaimed its $70 level, closing at a two-week high.

While traders have priced in a 0.25% rate cut for December, expectations for 2025 have significantly decreased, from six 0.25% cuts three months ago to just two for the entire year.

This makes me ponder: How will the markets respond to these changing expectations, especially since steadily rising rate cut expectations have been a key driver of the current equity bull market?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

Despite the challenges posed by the latest Consumer Price Index (CPI) report, the S&P 500 and Nasdaq showed resilience, with the Nasdaq achieving a significant milestone by closing above 20,000 for the first time.

This positive movement was mirrored by our TTIs, which also improved their positions relative to their underlying trend lines, indicating a strengthening market trend.

This is how we closed 12/11/2024:

Domestic TTI: +7.54% above its M/A (prior close +7.44%)—Buy signal effective 11/21/2023.

International TTI: +4.70% above its M/A (prior close +4.56%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli