- Moving the market

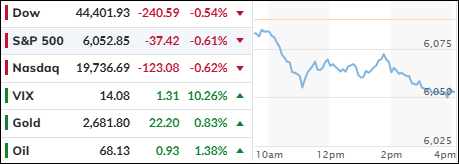

Equities declined ahead of key inflation data expected later this week, causing the major indexes to slip into the red.

However, gold defied the trend with a solid advance. Nvidia and Advanced Micro Devices faced pressure, with Nvidia dropping nearly 3% and Bank of America downgrading AMD from a “buy” to a “neutral” rating.

Last week’s gains in the S&P 500 and Nasdaq were driven by the November jobs report, which showed stronger-than-expected growth. This moderate growth has kept traders hopeful that the Federal Reserve will lower interest rates later this month, with current odds at 88%.

China’s economic stimulus measures boosted their markets, while momentum in the U.S. markets turned bearish. Despite this, the Mega Cap Tech sector held steady for the second consecutive day.

Bond yields edged higher, and Bitcoin briefly surpassed $100,000 before losing momentum and finding support at $96,500. Gold experienced a notable rise, and the dollar advanced after an initial dip.

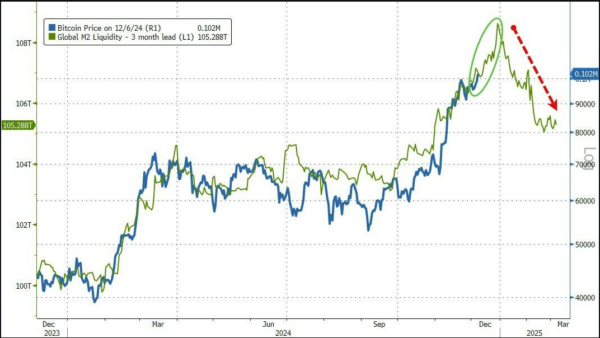

Despite Bitcoin’s correction, it continues to follow global liquidity trends with a slight lag. The following chart suggests potential upside towards the $125,000 level before a larger correction might occur:

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The market experienced the influence of seasonal weekly tendencies, resulting in a moderate decline in the major indexes.

Similarly, our TTIs mirrored this movement. However, the slight pullback in TTIs was largely insignificant and did not alter our overall positive outlook.

This is how we closed 12/09/2024:

Domestic TTI: +8.10% above its M/A (prior close +8.55%)—Buy signal effective 11/21/2023.

International TTI: +4.96% above its M/A (prior close +5.21%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli