- Moving the market

The major indexes began the session on a downward trend after scoring another positive week. With major corporate earnings on the horizon, future market gains will hinge on companies surpassing expectations as the earnings season intensifies.

Approximately 20% of S&P 500 companies, including prominent names like Coca-Cola, Tesla, and GE Aerospace, are set to release their earnings reports. So far, results have been mixed. Of the 14% of S&P 500 companies that have already reported, 79% have exceeded expectations, though the magnitude of these beats has not been particularly impressive.

Despite this, optimistic traders see potential for further gains. However, concerns remain about market overvaluation and the impact of ongoing geopolitical unrest, which could lead to increased volatility.

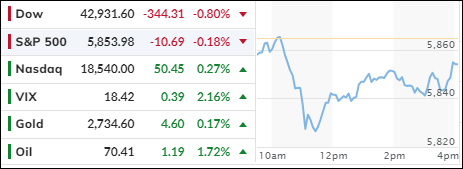

The Dow and the S&P 500 retreated, while the Nasdaq managed to close in positive territory. The release of the US Leading Economic Indicators, which fell to their lowest level since 2016, did not help market sentiment.

Gold and Bitcoin’s early rallies were erased as the bearish mood took hold. The most shorted stocks were hit hard as bond yields surged, causing a significant drop in prices. The 10-year Treasury yield rose by 11 basis points, closing just below 4.20%, which boosted the dollar to its highest level since August 1.

Gold reached a new record high early in the session but ended the day lower. Bitcoin followed a similar pattern, peaking at $69.5k before falling back to $67k. Crude oil reversed its previous losses and reclaimed the $70 level.

With the upcoming election just 10 trading sessions away, volatility is expected to increase, which can easily flip market sentiment.

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The stock market displayed a mixed performance, with the Nasdaq being the only major index to close the session with a gain. The rise in bond yields contributed to bearish sentiment, leading to declines for both the Dow and the S&P 500.

As a result, our TTIs surrendered some of the gains from the previous week but continue to indicate a positive outlook overall.

This is how we closed 10/21/2024:

Domestic TTI: +8.42% above its M/A (prior close +9.32%)—Buy signal effective 11/21/2023.

International TTI: +6.34% above its M/A (prior close +7.27%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli