- Moving the market

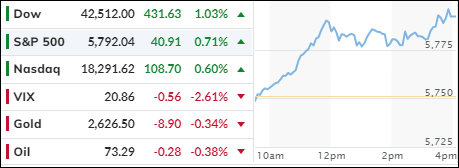

The markets attempted to build on yesterday’s recovery, with major indexes starting the day on a positive note.

This momentum was boosted by the release of the Federal Reserve’s September meeting minutes, which revealed that most participants favored a larger 0.5% rate cut over a more modest 0.25%. This news fueled bullish sentiment, leading to a strong market performance, with the Dow taking the lead and the S&P 500 reaching another all-time intraday high.

Overnight, however, China’s indexes declined, with their large-cap ETF dropping 2% following the previous day’s sharp selloff.

Wall Street’s recovery on Tuesday was driven by gains in the tech sector and a significant pullback in oil prices, which continued into today. Traders remain optimistic that the Fed can achieve a soft landing, a view primarily supported by last week’s headline jobs report showing continued strength in the labor market. However, a closer examination of prior revisions suggests this optimism may be misplaced.

The MAG7 basket continued its recovery from Monday’s plunge, while bond yields rose again, with the 10-year yield closing at 4.077%, well above the critical 4% level.

The dollar maintained its upward trajectory, reaching its highest point since August. This strength in the dollar weighed on gold and Bitcoin prices, both of which slipped, with Bitcoin testing the $61,000 level. Crude oil also retreated from Monday’s high.

Meanwhile, the U.S.’s foreign default risk reached its highest point since December, and despite the Fed’s rate cut, mortgage rates surged back up to nearly 7%, offering no relief to homebuyers.

Go figure…

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

The release of the Federal Reserve’s September minutes revealed a consensus among nearly all participants in favor of a 0.5% rate cut. This news gave traders the confidence to push the markets higher. As a result, all three major indexes closed the session with solid gains.

Additionally, our TTIs rose in unison, further affirming our current positive outlook on the market.

This is how we closed 10/09/2024:

Domestic TTI: +8.38% above its M/A (prior close +7.64%)—Buy signal effective 11/21/2023.

International TTI: +7.18% above its M/A (prior close +6.75%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli