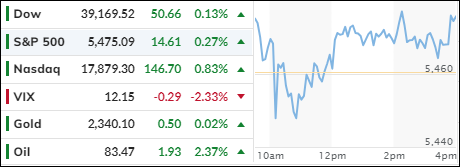

- Moving the markets

A choppy opening marked the first day of trading in July. Despite tech stocks edging higher there seemed to be some rotation out of that sector, as Nvidia slipped some 3% and leading other compatriots like AMD and Broadcom lower.

While some traders might dismiss the AI development as just another temporary mania, I think it is of great benefit for companies to increase productivity and utilize technologies in ways never thought of before. It will likely also start new industries and discoveries as AI and new more powerful chips combine forces to push computer science to a whole new level.

On the economic side, we learned that manufacturing declined in June despite expectations for some improvement. As ZH pointed out, both hard and soft data disappointed with especially the former diving sharply. As a result, the Fed’s GDPNOW forecast for Q2 GDP dropped to 1.7% from 4.3% a month ago. Ouch!

Bond yields rose but strangely enough did not affect stock prices, as you might have expected. The most shorted stocks rode the roller coaster, the MAG7 group dumped and pumped, while Bitcoin advanced over the weekend.

Gold trod water, crude oil rallied and reclaimed its $83 level, as that move will make its presence felt at the pump.

Back to Nvidia’s comparison with Cisco in the early 2000s. With the tech darling having shown some recent pullbacks, could this analog be still in play?

May be longer term, but right now we are facing the historically best seasonal two weeks for stock gains. Let’s see if this pattern repeats itself.

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

While the three major indexes closed the session with moderate gains, the rally was not broad-based and focused primarily on the tech sector.

As a result, our domestic TTI slipped while the international one eked out a gain.

This is how we closed 07/01/2024:

Domestic TTI: +4.45% above its M/A (prior close +5.30%)—Buy signal effective 11/21/2023.

International TTI: +6.53% above its M/A (prior close +6.22%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli