- Moving the markets

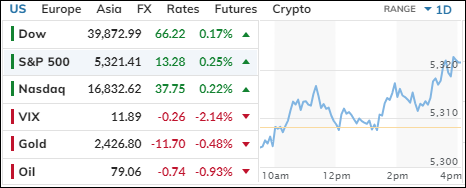

The major indexes hugged their unchanged lines today, hanging on to the record levels seen in the previous session, as traders eagerly looked toward Nvidia’s earnings report tomorrow. However, a last hour lift insured a green close.

There are two ways to view this important earnings announcement. On one hand, traders are heavily invested in the stock, so if the numbers are good, they won’t miss out on the instant rally. On the flipside, should the numbers be disappointing, a sell-off may be fast and furious.

Also, traders are listening to what the Fed’s mouth pieces are uttering. For example, Fed Governor Waller said he wants to see “several months” of supportive inflation data before lowering rates. Others, like Barkin and Bostic are due to voice their opinions later.

It’s interesting to note that traders have “brushed aside” several components of inflation amid some concerning consumer data points. Again, Wall Street has a hard time accepting the fact that “stagflation,” namely weak or no economic growth and continuing inflation, surrounds us.

It’s a quiet story and, while traders and algos have priced the markets for perfection, there are many events that could either disrupt the current scenario or even bring it to an abrupt end. However, for the time being, we remain in bullish mode.

Bond yields slipped wiping out most of yesterday’s dash, with the dollar whipsawing but erasing Friday’s losses. Bitcoin stumbled from its overnight surge, while gold hurried around all session but did not make any headway.

Temporary relief for consumers arrived at the pump, as the Biden Administration announced the release of its strategic gas reserve causing wholesale prices to retreat. Still, it looks like gas prices this coming Memorial weekend will be the second most expensive in a decade, as ZH pointed out.

That will matter this coming weekend. Right now, all eyes are on Nvidia’s earnings report. Will it help the bulls, or will bears find reason to rejoice?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

Uncertainty reigned throughout the session, but a last hour bump helped the bulls to score another green close.

Our TTIs trod water and changed only by a fraction, keeping our positive outlook intact.

This is how we closed 5/21/2024:

Domestic TTI: +9.34% above its M/A (prior close +9.39%)—Buy signal effective 11/21/2023.

International TTI: +10.43% above its M/A (prior close +10.40%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

—————————————————————-

Contact Ulli