ETF Tracker StatSheet

You can view the latest version here.

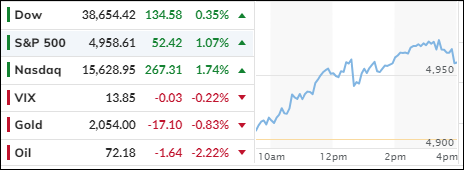

S&P 500 RISES DESPITE BOND YIELD SPIKE AND PART-TIME JOBS

- Moving the markets

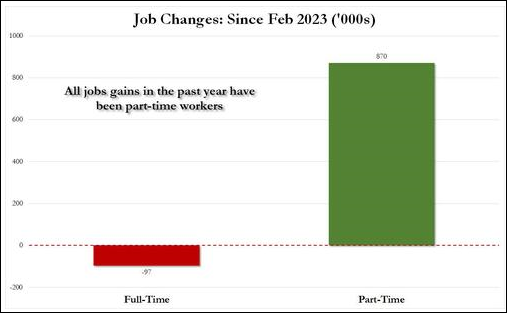

The S&P 500 soared again, ignoring the rising bond yields that threatened to spoil the party. The 10-year Treasury yield shot up to over 4% after the government claimed the U.S. economy created 353,000 jobs in January, almost double the expected number. But don’t get too excited, most of those jobs were part-time. Ouch indeed!

The jobs report also showed that wages grew by 4.5% year-over-year, more than the 4.1% predicted. This came after the Fed Chair Powell hinted that he was not in a hurry to cut rates in March. The lower unemployment rate and the higher average earnings suggested that the labor market was still strong. The question is whether this will dampen the market’s hopes for early rate cuts. The Fed could still keep us waiting until November.

On the bright side, the solid jobs report could also mean that inflation will stay under control as productivity keeps up, which will boost stocks. And speaking of stocks, Meta and Amazon stole the show with their stellar earnings. Meta’s shares jumped more than 21% after the social-media behemoth smashed analysts’ forecasts. Amazon’s shares rose 7% on its fourth-quarter beats.

The market also shrugged off Apple’s lackluster results. The shares barely moved after the iPhone maker reported a 13% drop in sales in China. The MAG7 stocks bounced back from Wednesday’s slump and reached new highs. But the banking sector was not so lucky, as regional banks had their worst week since May 2023.

Bond yields spiked, pushing the dollar higher and ending the week in positive territory. Gold went the opposite direction but still managed to gain for the week, while oil prices slid and closed lower.

One market commentator summed up the jobs report and the market reaction like this:

The market is soaring because AI hasn’t taken our jobs yet.

The market is soaring because every tech company is betting AI will take our jobs soon.

How’s that for clarity?

2. Current “Buy” Cycles (effective 11/21/2023)

Our Trend Tracking Indexes (TTIs) have both crossed their trend lines with enough strength to trigger new “Buy” signals. That means, Tuesday, 11/21/2023, was the official date for these signals.

If you want to follow our strategy, you should first decide how much you want to invest based on your risk tolerance (percentage of allocation). Then, you should check my Thursday StatSheet and Saturday’s “ETFs on the Cutline” report for suitable ETFs to buy.

3. Trend Tracking Indexes (TTIs)

Despite the rise in bond yields, traders focused on the positive news from Meta and the labor market. Meta reported impressive earnings that beat analysts’ estimates.

The economy added more jobs than expected, although most of them were part-time. The tech sector led the market rally and pushed the three main indexes higher. The S&P 500 was close to reaching its $5,000 milestone.

However, our TTIs showed a slight decline, indicating that the rally was not widespread across the market.

This is how we closed 2/02/2024:

Domestic TTI: +7.42% above its M/A (prior close +7.83%)—Buy signal effective 11/21/2023.

International TTI: +6.97% above its M/A (prior close +7.23%)—Buy signal effective 11/21/2023.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

—————————————————————-

Contact Ulli