- Moving the markets

Traders spent most of the day examining the latest earnings results for clues to determine whether optimism via higher stock prices was warranted. The major indexes meandered aimlessly around their respective unchanged lines, predominantly below it, until a last hour squeeze play assured a moderately green close, but it pulled the KBW banking index out of a deep hole.

The endless tug-of war, between those who believe that the Fed will soon end its tightening campaign and others, who are convinced that the rate hike campaign will continue, remained in full force.

It came as no surprise that, in view of the recent and still ongoing banking crisis, traders so far mainly focused on the health of financial companies to have a front row seat when it comes to spotting unwelcome shockers. None of the latter surfaced today, which may have led to the last hour jump of optimism.

As I pointed out last week, if you set the bar low enough, you will get desirable results. That was the case today in that 90% of the names that reported during the first week topped EPS estimates. Go figure…

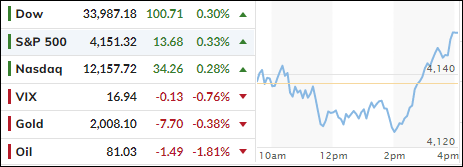

Bond yields rose, which helped the US Dollar gain 0.53%, but it hurt the precious metals with gold retreating 0.38% but holding on to its $2k level.

With more money printing on deck, it’s just a matter of time until precious metals will resume their ascent to higher prices.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend you consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices.

In my advisor’s practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs inched higher by a tad thanks to the last hour squeeze play.

This is how we closed 04/17/2023:

Domestic TTI: +2.64% above its M/A (prior close +2.29%)—Buy signal effective 12/1/2022.

International TTI: +8.36% above its M/A (prior close +8.32%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli