ETF Tracker StatSheet

You can view the latest version here.

PUMPING INTO THE WEEKEND

- Moving the markets

If it hadn’t been for the Ramp-A-Thon over the last two trading days of the month, the S&P 500 would have ended in the red during April.

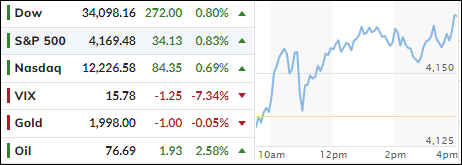

The Fed’s favorite Personal Consumption Expenditure price index (PCE) rose 0.3% in March, meeting expectations and therefore supporting the bullish theme for the moment.

Earnings were mixed, but FactSet reported that just over half of the S&P 500 companies have reported earnings so far, with 80% beating he much-lowered expectations, which in Wall Street’s way of looking at things creates a better sentiment, as markets don’t like to hear about misses. Go figure…

Yesterday’s economic news showed that Pending Home Sales dropped in March, as mortgage rates surged. Even the fact that Q1 GDP turned out much weaker than expected, as it slid from 3% in late March to only 1.1% yesterday, it could not generate a bearish response.

First Republic Bank (FRC) seems to be the next cockroach on the chopping block, after hope for a private deal turned out to be misplaced, with the stock taking another dump. The potential for a weekend bailout certainly exists, and could create a systemic threat, but none of that was able to disturb the bullish mood during this last trading day of April.

Not even the prospect of looming US debt defaults provided hesitancy in the markets due to the above-mentioned fantasy of “earnings beats” overriding all concerns. I suspect that this exuberant attitude will come to an end, as we move into May.

Of course, these kinds of bullish moves never happen in isolation, so it came as no surprise that the usual short-squeeze made its presence felt and assisted with this 2-day bullish run. Bond yields slipped for the week but were unchanged for the month.

The US Dollar swung wildly during the past 30 days and closed a tad lower, while Gold eked out a tiny gain.

On a personal note, I will be out Monday afternoon, so I won’t be able write the usual market commentary. However, should the markets behave in a way that threatens our current “Buy” mode, I will post a short update by 6 pm PST.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend you consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices.

In my advisor’s practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our Domestic TTI surged ahead and reached about the same point at which we started out the week. For the time being, the imminent threat of a “Sell” signal has passed.

This is how we closed 04/28/2023:

Domestic TTI: +2.15% above its M/A (prior close +1.03%)—Buy signal effective 12/1/2022.

International TTI: +7.47% above its M/A (prior close +7.27%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli