- Moving the markets

Upbeat earnings and robust consumer confidence data combined forces to pull the markets out of their doldrums and gave traders an excuse to push equities higher. Nike started things out by beating quarterly earnings and revenue expectations, as did FedEx with the company also announcing cost cutting plans.

Consumer Confidence surged in December (to 108.3 vs. 101 expected), as ZeroHedge posted, while inflation expectations tumbled to its lowest since August 2021. That put the bulls back in charge with nothing being able to stop today’s Ramp-A-Thon.

Not even horrific US Existing Home Sales, displaying their worst annual drop since 2008, could offset the bullish mood. However, the US Macro Surprise index showed the economy continuing to sink and the index has now reached its lowest point since early September.

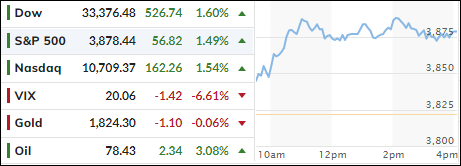

Bond yields dropped early on, rebounded, and slipped into the close ending the session just about unchanged. The US Dollar continued yesterday’s sideways pattern and held steady, as did gold with the precious metal remaining above its $1,800 level.

With only a few trading days left in 2022, the major indexes look to be snapping a 3-year win streak to post their worst year since 2008. As MarketWatch pointed out, the Dow is down 8.2% for the year and 3.6% for this month, while the S&P 500 shed 18.6% and 5%, respectively. The Nasdaq plummeted 31.5% in 2022 and 6.6% in December.

It was not a good year for the Buy-and-Hold crowd.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which starts on 12/1/2022, I suggest you reference my most recent StatSheet for ETFs selections. If you come on board later, you may want to look at the most current version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs jumped, but the Domestic TTI fell a tad short to pierce its trend line to the upside again.

This is how we closed 12/21/2022:

Domestic TTI: -0.31% below its M/A (prior close -1.83%)—Buy signal effective 12/1/2022.

International TTI: +1.65% above its M/A (prior close +0.53%)—Buy signal effective

12/1/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli