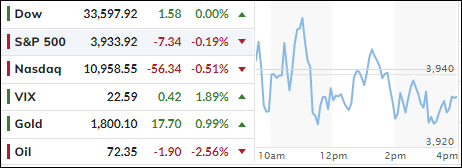

- Moving the markets

After 4 days of declines, the major indexes vacillated around their respective unchanged lines and, despite several breakout attempts, nothing was gained or lost. The exception was gold, with the precious metal adding 1% and closing right at its $1,800 level.

Worries about a worsening recession in 2023 remained on traders’ minds, along with critical upcoming data releases. Jobless claims on Thursday, November’s PPI and preliminary consumer sentiment on Friday will set the stage for next week’s highlights.

On Monday, we will find out whether the CPI has worsened or improved, and on Wednesday, the Fed will either deliver an expected 50 bps rate hike or an unexpected 75 bps. Either one will have an influence on market direction.

Today, even a plunge in bond yields was not enough to support equities, even though the 10-year dropped 11 bps to 3.43%, which caused the US Dollar to stumble and Gold to rise.

We may see some churning and grinding in the indexes until guesswork and uncertainty about the above-mentioned upcoming data sets are removed.

2. “Buy” Cycle Suggestions

For the current Buy cycle, which starts on 12/1/2022, I suggest you reference my most recent StatSheet for ETFs selections. If you come on board later, you may want to look at the most current version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs slipped a tad, as the recent sell-off slowed down but did not come to a halt.

This is how we closed 12/07/2022:

Domestic TTI: +0.99% above its M/A (prior close +1.16%)—Buy signal effective 12/1/2022.

International TTI: +1.56% above its M/A (prior close +1.74%)—Buy signal effective

12/1/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli