ETF Tracker StatSheet

You can view the latest version here.

GAINING FOR THE DAY BUT SLIPPING FOR THE WEEK

- Moving the markets

After four days of failed rebound attempts, the major indexes finally managed to squeeze out a gain for the day but ended up losing for the week in conjunction with the S&P 500 surrendering -0.92%.

Hope reigned supreme that the Fed might not deliver a full 1% interest rate hike later this month with traders wishing that we could be getting closer to the much-anticipated peak tightening.

Supporting bullish sentiment was preliminary retails sales data, which beat expectations. Also helping traders and algos alike were comments from Atlanta Fed President Bostic indicating he would “likely” not support a potentially higher rate move due to the negative influence on “undermining a lot of those things that are working well.”

On the other hand, the logic that strong retail sales could motivate a broad-based rally makes no sense to me, because that strong data point is exactly the reason for the Fed to continue its rate hikes. Otherwise, how else will they ever be able to slow down the economy and conquer inflation?

Yesterday’s ‘hot’ CPI reading of 9.1% clearly makes the case for more rate hikes. We have now a divergence with rate-hike expectations soaring and rate-cut expectations also soaring for next year, after the Fed “deepens the recession,” as ZeroHedge describes it.

Bond yields were mixed this week with only the 2-year gaining, while all others retreated slightly. After much bobbing and weaving, the 10-year closed back below its 3% level. The US Dollar continued its rampage, closed higher for the 6th week in the last 7 and ended at its highest since 2002.

Commodities tumbled for their 5th straight week, as did gold, with the precious metal testing its $1,700 level. Crude oil prices struggled as well and ended the week below $100.

In the end, the misery index says it all, since it is now at its highest since Carter was President.

Ouch!

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

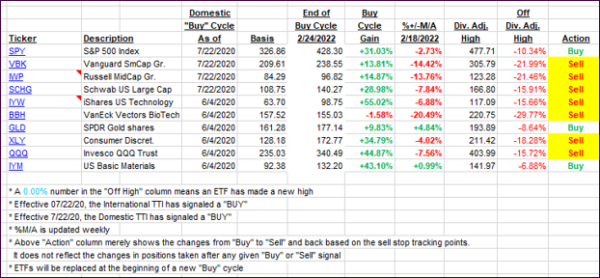

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this closed-out domestic “Buy” cycle (2/24/2022), here’s how some of our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -12% point has been taken out in the “Off High” column, which has replaced the prior -8% to -10% limits.

3. Trend Tracking Indexes (TTIs)

Our TTIs improved as stocks finally scored a winning session.

This is how we closed 07/15/2022:

Domestic TTI: -12.02% below its M/A (prior close -12.02%)—Sell signal effective 02/24/2022.

International TTI: -14.81% below its M/A (prior close -14.81%)—Sell signal effective 03/08/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli