ETF Tracker StatSheet

You can view the latest version here.

GRINDING OUT ANOTHER WIN

- Moving the markets

It was a struggle, but the major indexes managed to close in the green again and finish another week with a win. Early this morning, the Dow and S&P 500 made new all-time highs but skidded lower throughout the session.

Amazingly, the S&P 500 has continued to inch into record territory, despite mixed economic data and confusion caused by various Fed speakers on the topic of tapering, or more specifically as to when it is supposed to begin.

The University of Michigan’s consumer sentiment index collapsed with a weak reading of 70.2, which is the worst since September 2011. One strategist interpreted this number as reflecting not only higher prices but also increased concerns about the delta variant.

Yesterday’s jobless claims came in at 375k, not only in line with expectations but also on a declining trend for the third straight week. But the Producer Price Index (PPI) ratcheted higher by 0.9% last month vs. a forecast of 0.5%. And that is without the volatile food and energy components. Ouch!

In terms of performance “value” outperformed “growth” this week, although the spread has narrowed over the past two day, as Bloomberg shows in this chart.

Bond yields ran into overhead resistance, which is the 1.36% level for the 10-year, from which they retreated today. The US Dollar followed suit and plummeted on worsening consumer confidence. This combination of slipping yields and a sliding dollar proved to be precious for Gold, with its EFT GLD surging a well deserved +1.43% on the day, bringing the $1,800 level in reach again.

With consumer confidence plunging to 10-year lows, as ZeroHedge reported, what on earth could be driving stock prices relentlessly higher?

I am glad you asked. The answer is simple and clearly expressed in this chart.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

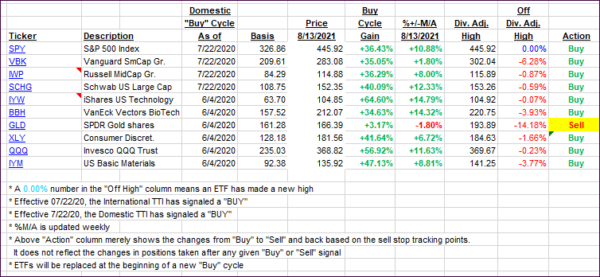

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs retreated as not much was gained today.

This is how we closed 08/13/2021:

Domestic TTI: +10.61% above its M/A (prior close +11.37%)—Buy signal effective 07/22/2020.

International TTI: +7.87+% above its M/A (prior close +8.18%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

Contact Ulli