ETF Tracker StatSheet

You can view the latest version here.

- Moving the markets

Though the quad withing hour increased today’s volatility, it was what the Fed did not do that added to with the banking sector’s sell-off mode after two days of gains.

The Fed decided not to extend “a pandemic-era capital break” for banks, also referred to as SLR (Supplementary Leverage Ratio) that stoked a rise in bond yields yet created bearishness in financial assets.

Explained CNBC:

The central bank on Friday declined to extend a rule expiring at the end of the month that relaxed the supplementary leverage ratio for banks during the pandemic. The rule allowing banks to hold less capital against Treasuries and other holdings was implemented to calm the bond market during the crisis and encourage banks to lend.

The decision could have some adverse effects, traders have warned, if in response banks sell some of their Treasury holdings. That could send yields even higher at a time when a rapid rise in rates is already unnerving investors.

In other words, fears increased that yields might edge higher merely as an unintended consequence and continue a trend that eventual will make stocks look less attractive. Keep in mind that the 10-year bond yield started 2021 below 1% and has catapulted to the current 1.72%.

The major indexes struggled throughout the week but are down by only moderate amounts with the Dow losing -0.3%, while the S&P 500 and Nasdaq dropped -0.9% and -1.3% respectively.

Looking at the big picture, ZH points out that we have just witnessed the greatest 12 month rally in the S&P 500 since the 1930s. And all it took was $13 trillion in global liquidity injections.

So, this was the short-term result. However, what will be the long-term consequences of creating such a vast amount of money out of nowhere?

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

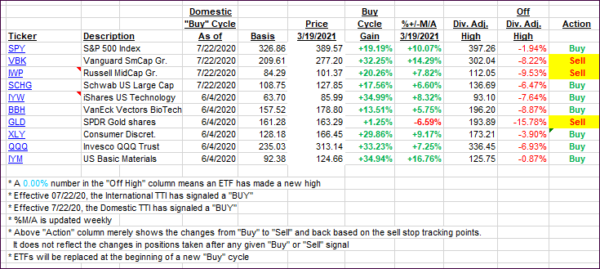

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs slipped again as the markets closed the week on the downside.

This is how we closed 3/19/2021:

Domestic TTI: +18.38% above its M/A (prior close +19.59%)—Buy signal effective 07/22/2020.

International TTI: +17.05% above its M/A (prior close +18.76%)—Buy signals effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli