ETF Tracker StatSheet

You can view the latest version here.

CLOSING THE MONTH ON A WEAK NOTE

- Moving the markets

Despite a slightly positive opening, the markets dropped sharply thereafter but attempted to rebound throughout the session. It was only the Nasdaq, which after some heavy drubbing early in the week, managed a green close, while weakness prevailed in the Dow and S&P 500.

A couple of our ETFs had triggered their trailing sell stops yesterday. Today’s pullback gave the confirmation I was looking for and those two were liquidated. Since both were volatile, this sale provided the perfect excuse to turn unrealized gains into realized ones and allow me, should bullish momentum pick up next week, to rotate into areas better suited in the current environment. If, on the other hand, the bears continue to flex their muscles, we will have reduced our market risk and will be able to better withstand a southerly trend.

The Dow was riding the roller coaster all day, swung wildly, and closed near the session’s low point. Wall Street continued its struggle with rising bond yields, which at some point will punish equities.

Have we reached this moment in time already? It’s too early to tell, but it is definitely a possibility. I think the situation will become much clearer as we enter March.

For the month of February, we saw the Dow and S&P 500 gain 3.5% and 2.61% respectively, with the Nasdaq only adding a meager 1.9%, as the second half of the month was not kind to the tech sector.

After having spiked to over 1.6% yesterday, bond yields calmed down a little with the 10-year retreating to the 1.42% area. The US Dollar index bounced off of yesterday’s low and, in combination with elevated bond yields, pushed gold down and below its $1,800 level—again.

Even though the indexes closed in the green for the month, most of the gains happened in the first half. Subsequently, bullish sentiment seems to have lessened over the past 10 days or so. This may be just a pause in an ongoing bull market, but it could also indicate a directional change.

Our trailing sell stops, once triggered and executed, will point the way to safety, should such a move become necessary.

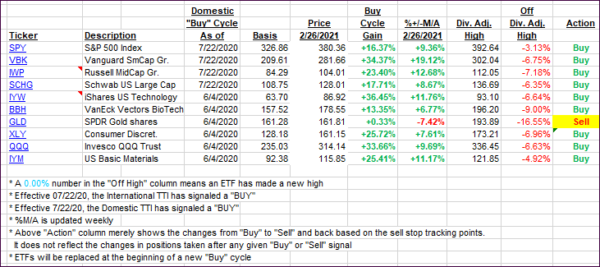

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge.

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs took a hit, as the bears dominated this week.

This is how we closed 2/26/2021:

Domestic TTI: +15.70% above its M/A (prior close +17.39%)—Buy signal effective 07/22/2020.

International TTI: +14.82% above its M/A (prior close +18.14%)—Buy signal effective 07/22/2020.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli