ETF Tracker StatSheet

You can view the latest version here.

BARFING INTO THE CLOSE

- Moving the markets

An early rally in the Nasdaq ran out of steam late in the session with the index following the Dow and S&P 500 via a sudden swan dive into the red.

The usual culprits contributed to the lackluster day, namely rising Covid cases along with worries about a worsening of the economic slowdown. The new kid on the block of concerns was a split, or rather lack of coordination between the Fed and the Treasury with the latter asking the former about the allocation of some $455 billion for the CARES act to be made available to Congress to reallocate:

The Fed was instantly triggered, issuing a counter statement saying the “full suite” of measures needs to be maintained and although the programs were not used extensively, Fed officials felt their presence reassured financial markets and investors that credit would remain available to help businesses through the pandemic.

While the spat continues, it left traders in a sour mood, which did not help the indexes, as the Dow and S&P scored their first weekly decline in three weeks.

Gold managed to eke out a gain in the face of not only equity weakness but also a sliding dollar and slipping bond yields.

Given the ever increasing monetary and fiscal stimulus packages, which show no signs of slowing down, my view is that anyone should make gold a core holding in their portfolio.

Analyst/money manager Peter Schiff has a similar view and describes the current environment this way:

People weren’t buying gold because of COVID. They were buying gold because of the monetary and fiscal policy that was a response to COVID. Well, since those policies are not going to go away — in fact, they’re going to get worse, we’re going to have even more monetary and fiscal stimulus, even if these vaccines work than we had before. So, there’s no reason to be selling gold based on a COVID vaccine. You should be buying gold based on the reality that it doesn’t matter what happens to COVID. We’re going to keep printing money and we’re going to keep interest rates artificially low.”

Wise words indeed.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

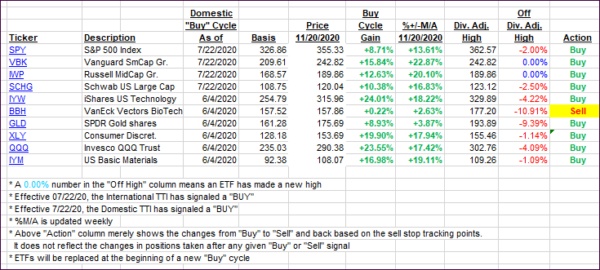

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs retreated a tad, as the major indexes slipped.

This is how we closed 11/20/2020:

Domestic TTI: +17.93% above its M/A (prior close +18.76%)—Buy signal effective 07/22/2020

International TTI: +15.67% above its M/A (prior close +15.86%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli