ETF Tracker StatSheet

You can view the latest version here.

STAGGERING INTO THE WEEKEND

- Moving the markets

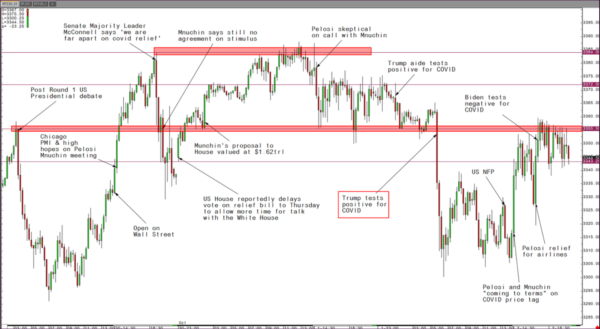

Traders woke up this morning to a real October shock, namely that President Trump and his wife had tested positive for Covid-19, after one of his senior advisors, who traveled with him, had tested positive as well.

The immediate reaction in the futures market was negative, but a rebound ensued as Europe opened.

“We’re just a month to the election so this news does throw the election campaign into a disarray for the Republican Party,” said Jingyi Pan, market strategist at IG Asia. “Even though Joe Biden is seen as the friendlier choice for Asia and a Trump absence could in some way or another keep that status quo of a Biden lead, generally, a contested election would generate uncertainties across the world and would not bode well for Asia equities as well.”

Added CNBC:

Still, the president’s diagnosis added more uncertainty to the election, an event that was already weighing on the market and keeping traders on edge as they attempted to evaluate the possible outcomes. It also raised concerns about a second wave of the virus and a slower reopening.

The regular session opened in the red and ended up there, but off the lows, with a lot of bobbing and weaving in between. In the end, the S&P 500 managed to eke out a small gain for the week.

It came as no surprise that the most volatile, and best performing index, namely the Nasdaq, fared the worst by dumping -2.22% while GLD, the ETF not the spot price, surrendered a negligible -0.11%.

Not helping the sour mood on Wall Street was the fact that only 661k jobs were added, which was way below the 868k expected. The US unemployment rate unexpectedly dropped below 8%, which made for a nice headline number. However, when looking under the hood, it turns out that the biggest reason for the drop in the jobless rate was people no longer looking for work. Ouch! Concluded ZH: The true unemployment rate is likely 8.4%, unchanged from last month.

The effects of the barrage of headline news on market behavior are nicely displayed in this graph by @AWMCheung:

Looking at the big picture, the analog to 1930 remains spot on, as Bloomberg’s updated chart shows.

It seems to me that the month of October will have many more surprises in store for us.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

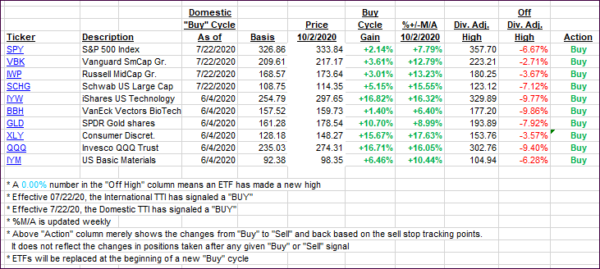

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs managed to eke out a gain despite the markets ending in the red.

This is how we closed 10/02/2020:

Domestic TTI: +6.47% above its M/A (prior close +5.88%)—Buy signal effective 07/22/2020

International TTI: +2.89% above its M/A (prior close +2.74%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli