ETF Tracker StatSheet

You can view the latest version here.

DOLLAR POPS AND GOLD DROPS

- Moving the markets

The declining US dollar finally showed some signs of life and rebounded causing gold, after its torrid run, to give back some of its outsized gains.

It was a choppy and sloppy day in the markets with the Dow and S&P 500 regaining all of their mid-day losses, while the tech sector and gold were not able to and stumbled into the weekend with moderate losses.

All three major indexes started the session on the downside, despite the US adding 1.76 million jobs in July, but hiring slowed after the latest coronavirus outbreak. Despite the unemployment rate falling for the third straight month to 10.2% from 11.1%, it became clear that this alleged recovery is very fragile in nature and can reverse or even bite the dust at any time.

That is why market reaction was muted with various asset classes selling off, in addition to the fact that no matter how bullish momentum may be, nothing ever goes up in a straight line. Given the strong gains earlier in the week, today was a day of pausing and profit taking with the mixed jobs report providing the perfect excuse.

Analyst Jim Bianco saw it this way:

Talks on passing the latest stimulus package are stalled. This is stimulus checks and additions to unemployment insurance.

Does anyone doubt if the stock market tanked 10% to 20%, they would pass this bill immediately?

But it does not tank because the Fed and their “unlimited printing press” stand ready to halt any “unpleasantness” in markets.

So, the better the “wealthy” do (stockholders) the less the urgency to help the “not wealthy” (non-stockholders).

The worst inequality ever?

Not helping matters was that the biggest weekly short squeeze in two months simply ran out of steam today, as Bloomberg’s chart shows.

In the bigger scheme of things, today’s pull-back was minor, especially when considering that for the week, the S&P 500 gained +2.45%, while the Nasdaq added +2.47%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

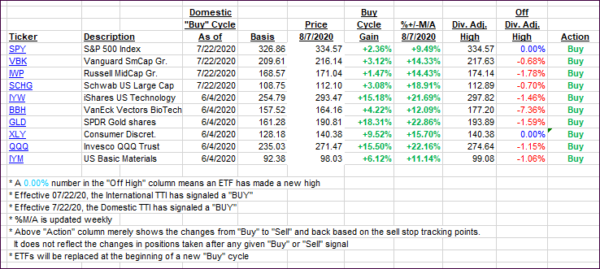

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs went opposite ways with the International one slipping a tad, while the Domestic one jumped sharply.

This is how we closed 08/07/2020:

Domestic TTI: +6.03% above its M/A (prior close +4.96%)—Buy signal effective 07/22/2020

International TTI: +2.83% above its M/A (prior close +2.96%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli