- Moving the markets

Another roller coaster day saw the major indexes fluctuate wildly with an initial rally being wiped out, which pushed the Dow and S&P 500 briefly in the red. The Nasdaq managed to stay in the green and then ripped to new intra-day highs late in the session, as all indexes joined in the bounce-back.

In the end, the Nasdaq again dominated the scene and produced another superb +1.44% gain, as we have seen all year long. The Dow and the S&P ended up only moderately higher.

Again, yesterday’s question as whether the unabated increases in Covid-19 cases in several states will delay a V-shape recovery continued to be the center of discussion. I believe it will, but another widely overlooked reason surfaced today.

ZH reported that the plunge in consumer credit continued as Americans repaid record amounts of credit card debt:

What we find most surprising, however, is that in this day and age when the Fed has effectively institutionalized moral hazard and where failure is no longer punished as capitalism is now officially dead and zombie existence is rewarded, Americans still care enough about their credit rating to pay down their own debt even as corporations and the country go on a historic debt issuance spree which everyone knows will never be repaid.

So how long until this shocking plunge in consumer spending reverses? The answer is that nobody knows, but until US consumers feel comfortable enough to once again “charge it”, there can be no recovery.

With 70% of the GDP being derived from consumer spending, a “true” organic recovery will not be in the cards until that sentiment changes again.

Regarding the markets, we must rely on the Fed’s expansion of its balance sheet to see further advances. As this chart shows, the flattening out in that very balance sheet has had the markets trading in a tight range since the early June highs.

Be that as it may, gold has been moving relentlessly higher and even its spot price has topped $1,800 for the first time since November of 2011, according to ZH.

Given the ever-increasing money printing efforts, which will lead to an increase of inflation and a decrease of the dollar’s purchasing power, gold should be an essential part in everyone’s portfolio.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

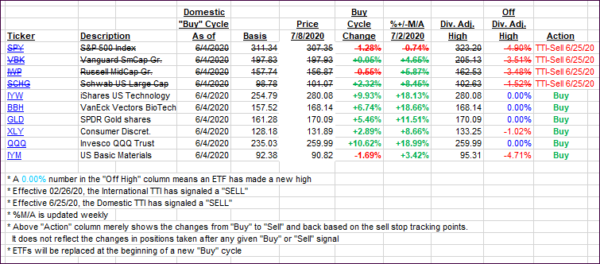

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this new domestic “Buy” cycle, which ended effective 6/25/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs rebounded from yesterday’s pullback, but still need a ways to go before crossing their respective trend lines to the upside.

This is how we closed 07/08/2020:

Domestic TTI: -1.41% below its M/A (prior close -1.70%)—Sell signal effective 06/25/2020

International TTI: -1.31% below its M/A (prior close -1.62%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli