- Moving the markets

The sudden turnaround in then markets kept me from liquidating those holdings that had come close to their trailing sell stops. It’s a known fact that sharp market drops can be followed by violent rebounds, which we saw early in the session. The only problem was that this move had the smell of a dead-cat bounce, which is exactly how it turned out.

Still, it was some relief from the selling stampede of the past few days, but it does not mean the economic effects of the coronavirus have been nullified. Far from it, as the confirmed cases of infections and deaths outside of China have continued to spread, there will be a financial hangover for some time to come.

Those investors that got motivated by buying the dips over the past few days were, with the benefit of hindsight, much too early and disappointed, as the dip-buy fest did not turn out well so far. To me, it’s doubtful that a V-shape type of recovery is possible soon.

In the end, it was only the Nasdaq which managed a green close with the other 2 major indexes slipping slightly in the red, which was somewhat disheartening given the early race out of the blocks.

As a result of today’s action, our main directional indicator, the Domestic Trend Tracking Index (TTI), dropped below its long-term trend line into bearish territory, although by only a modest -0.62%. That means that the odds of a bear market facing us have grown considerably.

Since this is the TTIs first dip “below the line,” I will start reducing our domestic equity exposure and will issue an all-out “Sell” signal, once the TTI shows some staying power in bear territory.

Again, I will hold off with any corrective measures, should the major indexes again be in rally mode during tomorrow’s session. However, if downward momentum accelerates, I will adjust my liquidations accordingly.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they

have been showing better resistance to temporary sell offs than all others over the past year.

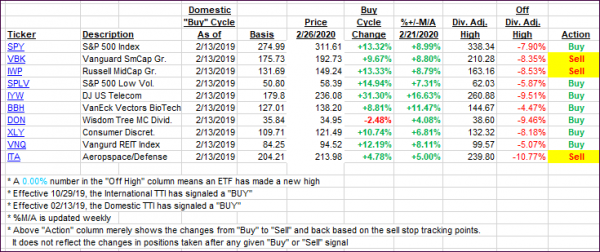

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped again as an early rally petered out and pushed the Domestic TTI below the “trend line” for the first time in over a year. I will look for more staying power before issuing and all-out “Sell” but will start reducing our equity exposure tomorrow.

Here’s how we closed 02/26/2020:

Domestic TTI: -0.62% below its M/A (prior close +0.35%)—Buy signal effective 02/13/2019

International TTI: -1.63% below its M/A (prior close -1.13%)—Sell signal effective 02/26/2020

We will liquidate those positions, which have triggered their trailing sell stops, unless there is a rebound in the making, in which case I will hold off for another day.

Our International TTI signaled a “Sell” effective tomorrow, but since we did not have any international holdings, we are not affected by it.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli